What is slippage?

Slippage is one of those dreaded moments of trade execution when price exceeds a stop or a limit order or even a market order. ( ? Types of forex trading orders ) Slippage is usually seen during periods of extremely high or low volatility and generally occurs during key news releases or during off market hours and occurs both in equity and forex markets and causes detrimental problems to traders.

Slippage is defined as the difference between the expected price and the actual executed price.

In the stock markets, slippage often occurs during market gaps. So if you intended to trade a particular price but the market gaps then your order is filled at the best available price, thus completely wrecking your trade risk/reward ratio. Of course, slippage is good when your target price is executed at a better price than the one intended, giving you a couple of extra pips in profit. But that is not always the case.

Figure 1: Slippage during Gaps

In the forex markets, slippage can occur both due to gaps or due to large (usually institutional) orders which tend to move the markets by a good 20 – 30 pips with all the orders in between being executed at a new (or best available) price. Slippage can also be seen during major breakout price levels, especially if a currency has been in consolidation for an extended period of time and has attracted a lot of attention from traders looking to trade the breakout range.

Slippage – An example

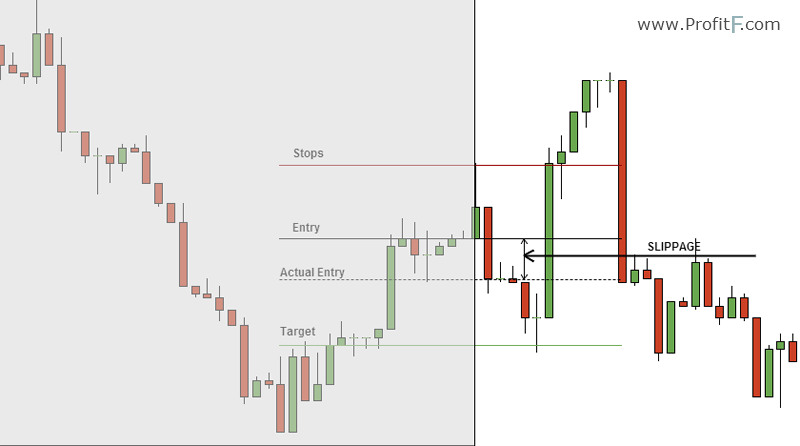

Take a look at the example below:

Figure 2: Slippage Example

Assuming that you wanted to place an entry at the low of the Green candle (end of the highlighted area) with take profit a few pips below the entry, the trade would have resulted in a slippage. The big bearish candlestick dropped like a rock before retracing some of that move. Due to lack of orders at your entry price, your order would have been executed much further away from your intended price level.

As you can see, the problem with slippage is that your order is triggered a different price than the one you intended it to be executed at. This not only increases your risk but also reduces the reward as well thus making it a very unfavorable trade.

Types of Slippage

Slippage can be classified into Positive and Negative Slippage, which is best explained with an example:

You place an order to trade at 1.3150.

Positive Slippage occurs when your Buy trade is executed at 1.3120 (giving you an additional 3 Pips in your pocket)

Negative Slippage occurs when your Buy trade is executed at 1.3180 (taking away 3 pips from your intended entry price level)

Can slippage be avoided?

Unfortunately, the answer is No. Regardless of the forex broker you trade with, slippage is something that a trader will experience at some point in their trading journey. Contrary to general opinion, slippage doesn’t indicate that your broker is playing tricks on you (although it is possible with Market maker brokers). It is essential to understand the market conditions under which slippage occurred. It is perfectly normal to experience slippage during important news releases such as the US NFP data or Central bank interest rate changes, where volatility and wild price swings are part and parcel of the trade.

While slippage shouldn’t really be cause for concern, traders can ensure to avoid slippage as much as possible by ensuring that trades are triggered either before or a few minutes after a news release happens. Although this can ensure that you are not a victim of slippage, depending on where your stops and limits are place, it could be possible for price to move in either direction and just take out your trade (either at a bigger stop level or at a higher take profit level).

Add your review