Forex arbitrage explained – what it is and how to use it

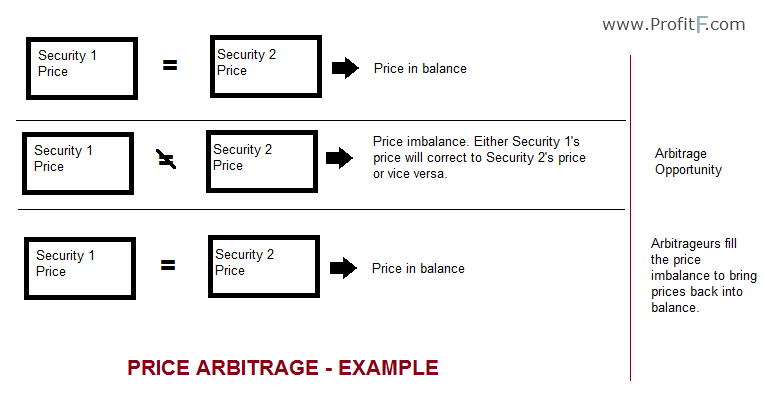

Forex arbitrage is a strategy that is used to exploit price discrepancies in the market. The concept was derived from the derivatives and the futures markets where a similar instrument, because it is traded as a derivate often tends to show an imbalance in pricing. The main logic that determines arbitrage is the fact that a security, regardless of where it is listed or traded should reflect the same price or value. When there is a discrepancy in pricing, it gives rise to a short term price imbalance which is taken advantage of by arbitrageurs. Arbitrage or forex arbitrage is also known as arb for short.

Such discrepancies which occur often present traders with an arbitrage opportunity. Arbitrage trading can be called self fulfilling as price discrepancies tend to be balanced out by the arbitrageurs themselves.

Price Arbitrage overview

A good way to understand arbitrage is to look at an instrument or a security which is traded in different markets. It could be spot vs. futures or a stock that is listed in two different exchanges or for the retail trader, it could be something as simple as trading the price discrepancies between two broker’s feeds.

Forex arbitrage trading; besides being rare, requires the trader to act quickly as the opportunities disappear just as quickly as they appear. Secondly, most forex brokers tend to use enhanced mechanisms to spot any trades that even remotely look like an arbitrage trade which could result in the profits being deducted. Finally, the currency pair’s spreads also need to be taken into consideration as most arbitrage opportunities that come by usually vary by a few pips only and when the spread is added to the equation, the profits are nearly negligible unless a trader is highly leveraged and well capitalized.

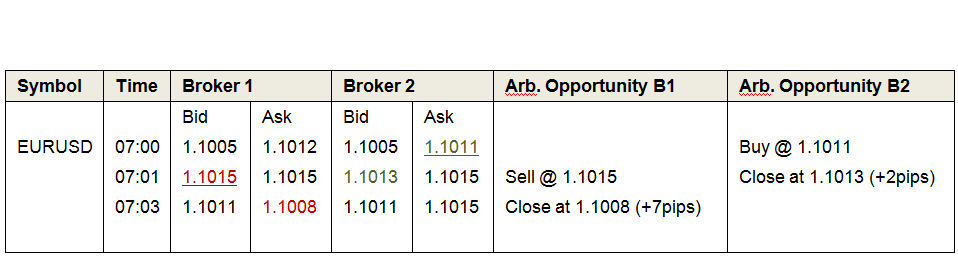

There are many types of arbitrage strategies available but they follow the general principle. At its simplest form, currency or forex arbitrage requires using two different brokers and comparing the price feeds, illustrated below in the table. It is also known forex arbitrage (or broker arbitrage). The trader would buy on the lower quoted ask price and sell the higher quoted bid price

Buy order P/L: 2 Pips

Sell order P/L: +7 Pips

The above table shows a very basic arbitrage strategy involving two broker feeds and buying the lower Ask and selling the higher Bid prices. Notice that the price discrepancies are just for a mere few seconds and it also does not involve the spreads. The above example illustrates that when using a broker arbitrage strategy, traders will have to be quick to take advantage of the price imbalance.

Triangular Arbitrage is another way to trade. In this approach, traders use three different currencies which involve buying and selling in order to exit for a profit on the main currency that is being targeted.

Example: Buying EUR by selling the US Dollar and selling the EUR to purchase the GBP and eventually selling the GBP to purchase USD. A simple way to illustrate this is with the following example:

EURUSD ask price @ 1.10: You buy 100,000Euro by selling 110,000 USD Dollars. So your initial expense is 110,000 US Dollars. With the 100,000 Euro, you now sell it to purchase GBP. EURGBP bid price is at 0.7, so you sell 100,000 Euro to buy 70000 GBP, and you then sell 70000 GBP to buy USD where GBPUSD bid price is 1.50 which leaves you with 150,000US Dollar.

From the above, for an initial investment of 110,000 by triangular arbitrage, you essentially ended up with 150,000 a profit of $40,000.

However, the above quoted example is merely a textbook example and more often than not, prices change so quickly which yet again brings to highlight the fact that traders need to be very quick in executing the trades. Another factor is the delay in execution which depends on your connection speed and the broker’s execution speed, all of which can make or break the strategy.

There are many automated software applications that specialize in forex arbitrage strategies which help to take out the guessing from the game and thus present the trader with ready to execute trading decisions.

Add your review