What are Gaps in trading and how to trade Gaps

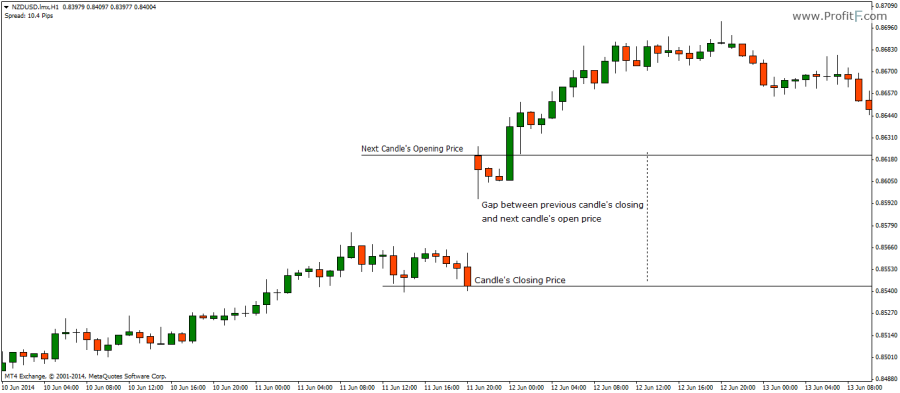

Gaps in trading are a common phenomenon and very commonly occurring in stocks. A gap is formed when the opening price for the day is higher or lower than the closing price of the previous day. A gap is nothing but an empty space between the closing price of the previous candle and the opening price of the next candle.

The chart below is an example of a Gap formed on NZDUSD. Here, we can see the difference between previous candle’s closing price and the next candle’s opening price, indicating a very bullish sentiment.

Why are Gaps formed?

Gaps are formed when there is an extreme sentiment in the market and when bulls or bears overwhelm the other. Gaps in the forex markets can often be seen during important news events, or on the first price candles of the week when the market is closed during the weekend. Gaps can be easily distinguishable on Candlestick charts or OHLC bar charts. ( ? Read more about Forex Trading the News)

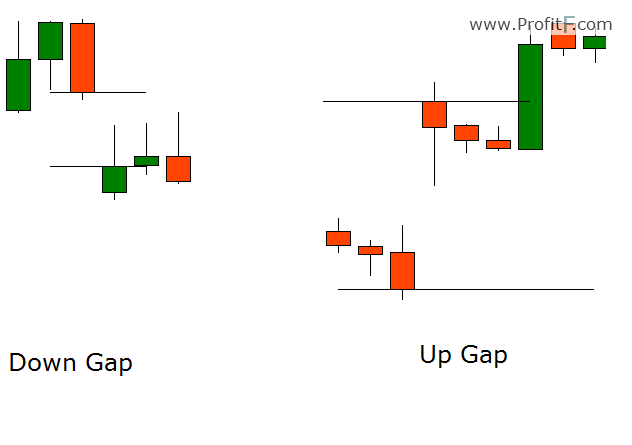

Gaps are identified individually as a Down Gap and an Up Gap.

A down gap is formed with the opening price is lower than the closing price of the previous day. An up gap is formed with the opening price is higher than the closing price of the previous day.

The chart below is an example of an up gap and a down gap.

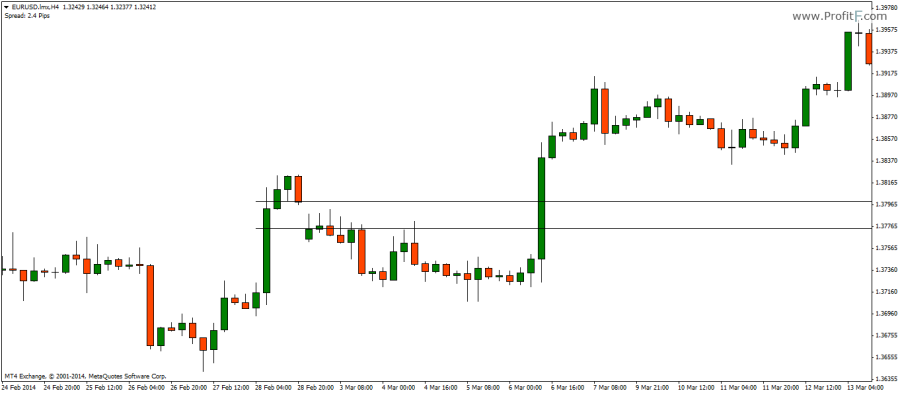

When you hear about Gaps, there is a common saying that “Gaps are meant to be filled”. In other words, if a Gap is formed, traders believe that price always comes back to fill that Gap. This philosophy needs to be taken with a pinch of salt. For example, when a Gap is formed, price can almost immediately or within the span of a few hours can reverse and fill the gap. And at times it can take weeks or months for a Gap to be filled.

The above chart shows how the Gap that was formed on 12th of July 2014, was filled some weeks later around 23rd July.

The next chart below shows another example of a Gap that was filled within a few days.

Therefore, while it is true that gaps are meant to be filled, there is no saying in how long it could take for the gap to be filled.

Types of Gaps

Gaps can be classified into the following four types:

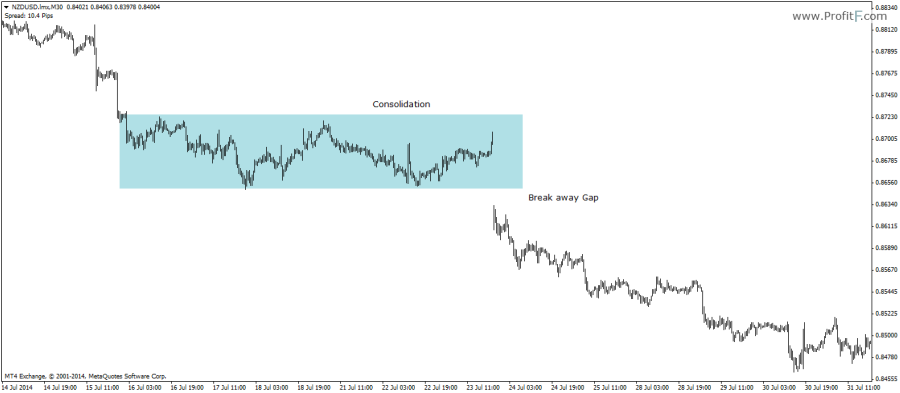

Break away Gap: A break away gap is typically formed at the start of an uptrend or when price is just coming out of a consolidation phase. It is known as a breakaway gap because price tends to break out from its previous consolidation to establish a new market move. The chart below shows an example of a breakaway gap that was formed right after a prolonged period of consolidation.

Runaway or Continuation Gap: This type of gap is formed within the prevailing trend and is usually said to occur mid way of a trend. When a runaway gap is identified, traders know that the previous trend will continue and trade in the direction of the trend. Trading the continuation or runaway gap is probably one of the safest methods to trade, especially when combined with other trading methods such as support/resistance or trend lines. The chart below shows a continuation gap that was formed in the middle of the uptrend.

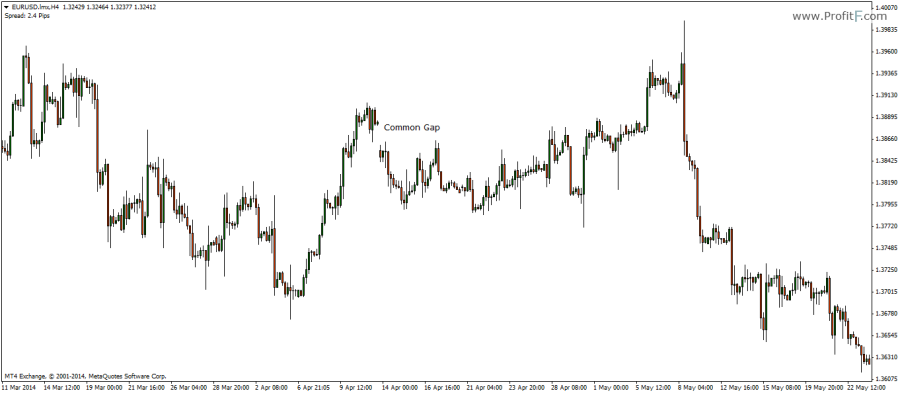

Common Gap: This is one of the least important gaps and is formed, as the name suggests, commonly. Common gaps can be formed at any time of the trading session. Common gaps are more likely to be filled within a few price bars and can therefore be used for very short term intra-day trading. The chart below shows a common gap that was formed, notice how quickly this gap was filled.

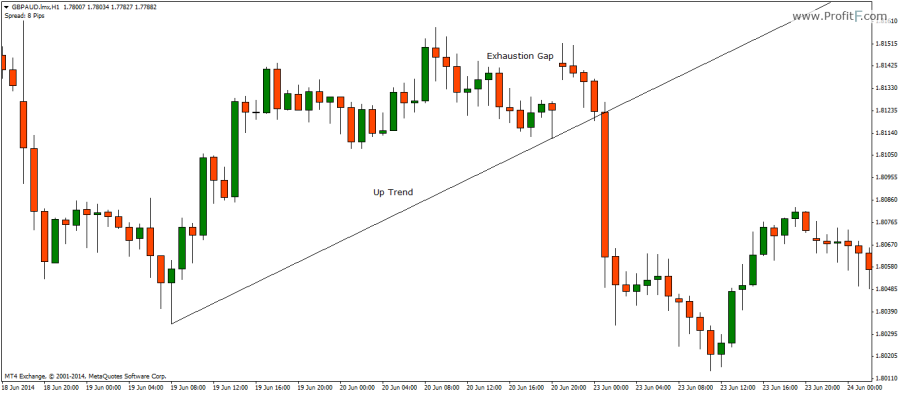

Exhaustion Gap: Exhaustion gaps are formed towards the end of the previous trend and indicate the last final push in momentum before prices start to fizzle out. Exhaustion gaps are better found with stocks as it is commonly identified with a gap being formed with an unusual surge in volume. In forex however, volume is not a reliable indicator and therefore exhaustion gaps should be considered along with the prevailing trend and possible support/resistance levels. Exhaustion gaps occur within the direction of the previous trend. Example, in an uptrend, exhaustion gaps are identified with an up gap (or down gap if the previous trend was a down trend).

The chart below shows an exhaustion gap being formed after a brief rally. Notice how after the gap was formed, price quickly changed direction and continued to fall.

Gap Trading – Conclusion

Gaps, in the forex market are a common phenomenon and depending on the type of Gap that was identified, long or short positions can be taken. If you are not sure about trading with Gaps, gaps can alternatively be used as a confirmation signal. For example, when you notice a runaway gap being formed, you can take a position based on the prevailing trend, knowing very well that run away gaps are formed in the middle of a trend. Gaps can therefore be a helpful way to understand the market sentiment and trade accordingly.

Add your review