Forex, what is margin? What is margin call? What is margin level? Forex Margin definition

When trading, margin is often mentioned by forex brokers. Margin is nothing but collateral that is maintained in order to keep positions open. It is also referred to as a margin deposit and is automatically deducted when opening a new trading position. Margin is quoted in relation to 1 lot.

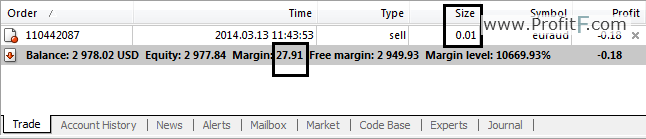

Figure 1: Margin

In the above image, Figure 1: Margin we notice that a margin of 27.91 was allocated to an open position of EURAUD for 1 micro lot (0.01). The margin is the minimum amount required to maintain an open position for EURAUD and is deducted automatically from the available equity and is released once the position is closed. The margin required varies based on the leverage used. To better understand margin, let’s take a simple example of buying EURUSD for a trading account that has a 1:1 leverage.

Assuming that you want to buy 1 micro lot (or 1000 units) of EURUSD at 1.395, the margin amount required to open a buy position would be 1000 x 1.395 = €1395.

If your trading account has a total equity of €10,000, then when you open a trading position of 1000 units, the amount of €1395 is deducted as long as the trade is kept open. The margin amount is released once the position is closed.

The difference between the margin amount and the equity is what is referred to as free margin. This free margin can be used for opening other new positions.

The ratio of equity to margin is what is referred to as margin level.

Margin Call – event when forex broker automatically closes open orders thus preventing trader from entering into debt.

Add your review