Below is the outcome of last week’s high impact economic events;

| Event | Day | Expected | Outcome |

| UK Markit Services PMI | Monday | 50 | 52.9 |

| Australia rate decision | Tuesday | 1.5% | 1.5% |

| Switzerland GDP | Tuesday | 0.9% | 2.0% |

| US Non- Manufacturing PMI | Tuesday | 55 | 51.4 |

| Australia GDP | Wednesday | 3.2% | 3.3% |

| Canada interest rate decision | Wednesday | 0.5% | 0.5% |

| Japan Current Account | Wednesday | 2090B | 1938.2B |

| Australia Trade Balance | Thursday | -2750M | -2410M |

| ECB interest rate decision | Thursday | 0% | 0% |

| US Building permits | Thursday | 3% | 0.8% |

| US Initial jobless claims | Thursday | 265K | 259K |

| Switzerland Unemployment rate | Friday | 3.4% | |

| Canada Unemployment rate | Friday | 6.9% | 7.0% |

Table; High impact economic events outcome (5th August – 9th September)

Last week was characterized by Canada and the ECB keeping their interest rates constant as expected at 0.5% and 0% respectively. Earlier in the week, Australia also kept its interest rate constant at 1.5% as expected while its GDP was 0.1% higher than the expected. US Building permits had a worse than the expected reading of 3% coming in at 0.8% while Initial Jobless claims dropped from 265K to 259K.

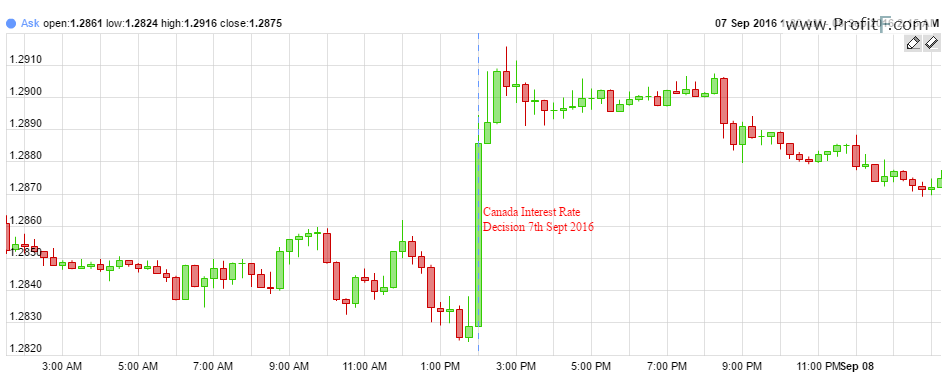

The figure below shows the impact on news release of the Canada interest rates on the USDCAD showing a quick loss of the Canadian dollar against the US dollar;

Figure; 7th September Canada Interest Rate Decision Impact on USDCAD (15min Chart)

Last Week’s CFTC COT Report (6th September 2016);

| Currency | Net Commercial Positions (previous) | Net-Large Speculators Positions (previous) | Net-Small Speculative Positions (previous) |

| EURO | 113,340 (100,808) | -92,630 (-81,925) | -20,710 (-18,883) |

| AUS | -43,568 (-47,061) | 38,959 (42,566) | 4,609 (4,495) |

| GBP | 103,984 (114,454) | -89,969 (-92,485) | -14,015 (-21,969) |

| CAD | -30, 005 (-34,035) | 20, 905 (22,400) | 9,100 (11,635) |

| JPY | -49,904 (-57,204) | 54,489 (63,661) | -4,585 (-6,457) |

| CHF | 8,779 (4,722) | 1,451 (8,208) | -10,230 (-12,930) |

Table; COT Report for 6th September 2016 (Data CFTC)

Net-Large Speculative long positions declined across the board on the Euro, Aussie, CAD, JPY and the CHF. The Euro and the Aussie had consecutive losses on their net-large speculative positions. The GBP on the other hand decreased in its Net-large speculative short positions from 92,485 to 89,969. Below will be the main highlights for the week:

Summary

| Event | Date | Previous | Expected |

| UK Consumer Price Index | Tuesday, 0830 GMT | 0.6% | 0.7% |

| German ZEW Economic Sentiment | Tuesday, 0900 GMT | 4.6 | 6.7 |

| ECB President; Draghi’s Speech | Tuesday, 0900 GMT | ||

| UK Unemployment Rate | Wednesday, 0830 GMT | 4.9% | 4.9% |

| US Crude Oil Inventories | Wednesday, 1430 GMT | -14.513M | |

| New Zealand GDP | Wednesday, 2245 GMT | 0.7% | |

| Australia Unemployment Rate | Thursday, 0130 GMT | 5.7% | 5.7% |

| SNB Interest Rate Decision | Thursday, 0730 GMT | -0.75% | -0.75% |

| UK Interest Rate Decision | Thursday, 1100 GMT | 0.25% | 0.25% |

| US Retail Sales | Thursday, 1230 GMT | 0% | 0% |

| US Initial Jobless Claims | Thursday, 1230 GMT | 295K | |

| US Consumer Price Index | Friday, 1230 GMT | 0.8% | 1% |

| Reuters/Michigan Consumer Sentiment Index | Friday, 1400 GMT | 89.8 | 91 |

Table; High impact economic events (12th – 16th September 2016)

FOMC Member Governor Lael Brainard Speech Monday Sep 12, 17:00 GMT FED Brainard Speech LIVE STREAM >>

UK Consumer Price Index: Tuesday, 0830 GMT. The UK CPI rose from 0.5% to 0.6% in July and is expected to rise to 0.7% this month.

German ZEW Economic Sentiment: Tuesday, 0900 GMT. This index is expected to beat the previous figure of 4.6 and register 6.7 for the month of August.

UK Unemployment rate: Wednesday, 1430 GMT. Fears on the Brexit vote decreasing the number of jobs in the UK have subsided and the unemployment rate is expected to remain constant at 4.9%.

US Crude Oil Inventories: Wednesday, 1430 GMT. Stockpiles decreased by over 14.5M last week which was a major drop in a few years. This number is expected to remain constant.

New Zealand GDP: Wednesday, 2245 GMT. The previous reading on the New Zealand Gross Domestic Product was 0.7%, a lower reading than the last quarter reading of 2015 which was 0.9%. However, the GDP is expected to rise for the remaining part of the year.

Australia Unemployment Rate: Thursday, 0130 GMT. Employment numbers in Australia are expected to change by 15K while the unemployment rate is expected to remain constant at 5.7%.

UK Interest Rate Decision: Thursday, 1100 GMT. The BOE cut interest rates to 0.25% in July and the expectation is that this rate will be held constant.

US Retail Sales: Thursday, 1230 GMT. The Retail Sales are expected to remain constant at 0%. Initial Jobless Claims on the other hand registered at 295K last week beating the expected figure of 264K.

US Consumer Price Index: Friday, 1230 GMT. The Consumer Price Index is expected to rise to 1.0% from a previous figure of 0.8% while the CPI excluding food and energy is expected to remain constant 2.2%.

Reuters/Michigan Consumer Sentiment Index: Friday, 1400 GMT. This index is expected to rise from 89.8 to 91 this month. This one of the last high impact release next week and the markets to watch are the USD crosses.

You can view all the events scheduled this coming week in Economic Calendar

Subscribe to Newsletter “Overview of Major economic news next week”

(1 email/Week)