Now that we have an understanding of the basic overview of the binary options market, in this article we’ll go into a bit more detail. You will learn how to trade binary options and how the profit/loss is calculated. To gain context, it is recommended for the readers to read on the ‘Binary options overview’ article to especially learn about the terminology such as CALL, PUT, In-the-money, Out-of-the-money and so on.

Trading CALL Options

A CALL option is where a trader believes that the price of a security will increase in value by the time the option expires. For example a trader would place a CALL option on EURUSD at a strike price of 1.38. This means that the trader expects EURUSD to trade above 1.38 by the time the contract expires. If EURUSD does indeed expire with a price higher than 1.38 the contract is deemed to have expired in-the-money. Depending on the return offered for the contract, the trader makes an appropriate profit.

CALL Option – Example

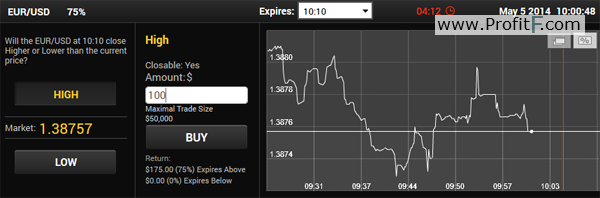

The above picture shows how a CALL option is placed.

The contract has an expiry time of 10:10 (10 minute expiry). So when a CALL (or HIGH) option is placed, the trader expects EURUSD to trade above 1.38757 (the strike price) by the time the option expires at 10:10.

If EURUSD does trade higher than 1.38757, the trader gets a 75% return on the invested amount of $100, which is $75.

If EURUSD trades lower than 1.38757, the trader loses the invested amount of $100.

Trading PUT Options

A PUT option is purchased when a trader believes that the price of a security will drop by the time the contract expires. For example, if a trader thinks that EURUSD will drop in value, then a PUT Option is purchased. If EURUSD does trade lower than the price at which the option contract was entered, the option is deemed to have expired in the money and the trader therefore makes a profit. However, if EURUSD trades higher than the price at which the option contract was entered, then the option would expire out of the money, with the trader losing their invested amount.

PUT Option – Example

The above picture shows a PUT (or LOW Option). By purchasing the PUT option, it is expected that EURUSD was will lower than 1.38740 by the time the contract expires at 10:15. The trader can either risk losing $100 if the option expires out of the money or can stand to profit $75 if the option expires in the money (i.e: trades lower than 1.38740).

Trading an Option with Buy-Back or Early Close

Some binary options brokers offer an early close or a buy back feature. This is available on selected instruments and allows a binary options trader to close their contract before expiry. This can be used to minimize the losses. For example, if you placed a CALL option and the instrument started to trend lower, then the trader can close the option contract before expiry. This prevents the trader from losing their entire invested amount and settle for a smaller loss.

The above image depicts a PUT option that was entered at a strike price of 1.38754.

This trade has the following risks and reward:

A risk of losing $50 which was invested if the option expired out of the money and a reward of making $37.5 if it expires in the money.

During the course of the option, if the trader believes that the option is likely to expire out of the money, they could use the ‘Close’ option. In the above chart, notice that an early close would result in losing only $11.37 (you would get back $38.63) instead of losing the entire $50.

The buy back or early close option is therefore a valuable additional risk management tool that can be used by the trader. However, note that the early close/buy-back option is available only up to a certain point in time. The feature will not be available 10 minutes ahead of the contract expiry time. So traders should take note of this.

? Read more about Binary Options Features (Sell, Rollover, Double Up)

Understanding Profit/Loss in Binary options

The profit/loss calculation is very simple with binary options.

Your risk (or losing amount) is always the amount that you invested.

The reward (the amount you can profit) is the percentage specified for the option.

For example a CALL option with a 75% return means that the profit a trader can make is 75% of the amount they invested in the option.

To conclude, binary option is very simple and easy to trade. With clear risks and rewards specified even before you enter a contract, a trader is quite in control of their trades. Also by additionally using the buy-back or early close feature, a binary options trader can be able to control their risks even better. Interested to know where to trade binary options? Click here for a review of the binary options brokers

Add your review