TABLE OF CONTENTS:

Gap trading, like any other type of trading, involves significant risks upon abnormal functioning of the market. This is why it is not strongly recommended for beginning traders. First of all, you need to be well prepared from the point of technical analysis and moral state before going to the frontline of trading not to forget to abide by your own rules at the moment of crucial importance. (read more about Gap Trading)

In fact, binary options truly open the doors to the Narnia – the world of strictly adjusted risks and absolutely new trading possibilities. (How to Trade Binary Options) You don’t need to worry about unforeseen losses or wait patiently for the profit on position to be accumulated. Binary options allow already forgotten trading strategies to get a new burst of energy and revitalize their capacity to yield further profits. In this article a gap trading method and its potential in the world of trading binary options contracts are addressed. Before we go directly into the question of trading binary options on gaps, let’s give a definition of gaps first and then find out the reason of their occurrence.

Gap is an abnormal break between prices, where the difference between an opening price of a new time period and a closing price of the previous time period is much larger than usual.

There is no a clear definition of a gap and, in fact, any substantial break between prices can be considered as a gap. We are interested exactly in substantial gaps, namely, those that can be traded.

Gaps occur due to a wide range of reasons, including such primitive ones as technical reasons. They mostly appear during pauses between trading sessions. As for the Forex market, it often gaps at the Monday opening. Alternatively, a company unexpectedly declaring its bankruptcy on the first day of a weekend can be responsible for gaps: traders begin to move their orders actively, and the Monday’s opening price may be much lower than the Friday’s closing price.

The most common reason for gaps occurrence in the Forex market is orders accumulated over a weekend. Demand for currency grows violently during the market inactivity (namely, over a weekend). As a result, a number of Buy and Sell orders is accumulated. These orders begin to be filled at the market opening (from Sunday to Monday), and a gap, which represents a break between the last Friday’s price and the first Monday’s price, occurs on the chart.

Therefore, demand for currency increases violently over a weekend; when these orders trigger at the market opening, a gap occurs.

Roughly speaking, gaps occur due to changes in sentiment of market participants caused by some fundamental factors. The factors may include unexpected events in the financial markets, natural disasters, political pressures, terrorist threats or a new bailout for economy by Mario Draghi.

Gap needs not necessarily form over a weekend or at nighttime, although it happens a lot more often in practice. Breaks between priices can also occur during shorter time frames. Since a consistency of quotes flow strongly depends on presence or absence of liquidity, lack of the liquidity may lead to significant up and down price moves.

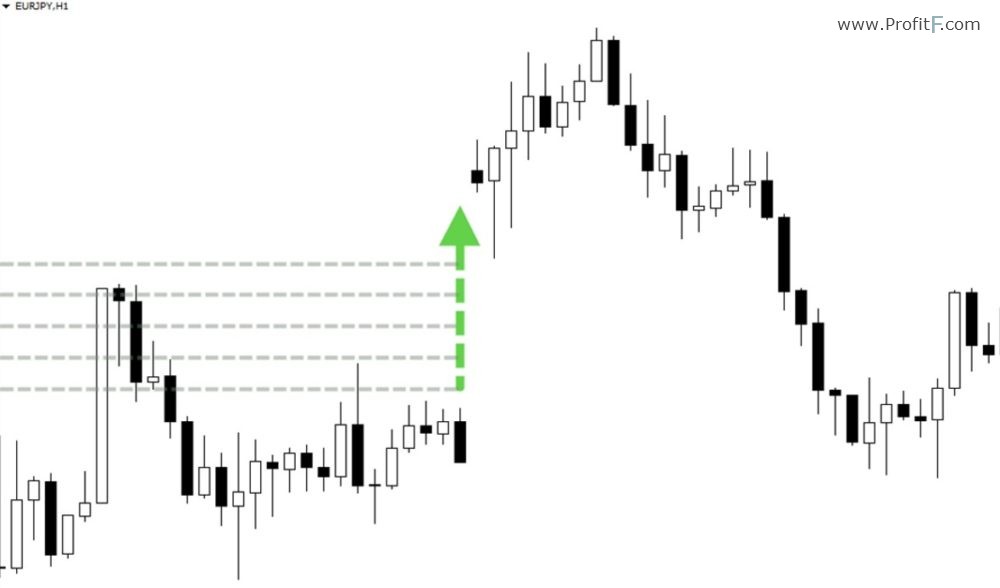

The important feature of gaps is that prices eagerly tend to move back to the original pre-gap level (“fill the gap”). The given behavior of market participants is as natural as a price bounce back from a round number level or a price ranging within a channel. A price move after leaving a gap has some similarities with a wave washing out pending orders set by market players who haven’t yet realized their losses. As a result, an instrument prints a natural bounce back on the chart, until it strikes a balance at the level of a “fair price”.

Though gaps tend to be filled in most cases, sometimes there are situations where a price continues to move in the same direction after forming a gap. Usually it happens when a prolonged trend move backed by strong fundamental factors precedes a gap.

Forex gaps are a comparatively rare thing. The most substantial gaps occur at the week’s opening, during which the first trading session opens on Monday, when a sufficient number of Buy and Sell orders has been accumulated over a weekend. Besides, occurrence of gaps is often related to releases of important economic news and fundamental forecasts.

Therefore, it makes sense to trade currencies on gaps either prior to important news releases or at the Monday’s opening. In this case you should pay your attention to choosing pairs suitable for trading. The best performance shows the following pairs: EURUSD, GBPUSD, EURJPY, and GBPJPY. Gaps for the given instruments are filled in about 70% of cases.

At the same time, breaks between prices for shares are a relatively everyday occurrence. Gaps may appear during a trading session, when traders don’t provide enough liquidity, and at the opening of a new session, when the most substantial gaps occur. Another obvious benefit of shares is a wide range of instruments for analysis, although most brokers offer only several dozens of the most favorite shares.

Trading on gaps in the binary options market is rather easier than in any other market. You don’t need to know in advance, what distance a price will cover and thereby a gap doesn’t necessarily need to be completely filled. The reverse situation, where a price moves from a gap, also enables you to get a feel for another benefit of binary options: no matter how much a price has gone, the outcome of a trade is prejudged beforehand.

There are two types of binary options that best suit for gap trading: traditional (classic) and Touch options. The rules are simple: when a gap occurs, wait for about 30 minutes and then enter the market in the direction of the break between prices. At that, a gap size must be equal, at least, to 20 points. Expiration time for Forex instruments must be about 5-8 hours. As for binary options for shares, they must expire at the close of a trading session, i.e. their expiration time must be equal to about 8 hours. The exact expiration time can be determined experimentally.

As you can see from the chart below, once a gap forms on the GBPUSD chart, a price keeps moving in the gap direction for some time, but then it reverses in a couple of hours and begins its movement towards the gap testing the resistance level along the way.

There are absolutely perfect situations, where an instrument that has unfairly declined in price is making up for lost ground.

The stock market offers rather more trading opportunities, but at the same time gaps are filled less often. The result of it is a growing number of losing trades that is compensated by their amount in some way. The stock market provides with a great many opportunities indeed, so you might find a suitable instrument after carrying out your own research.

Pay attention to the time, from which it is allowed to begin trading on Monday, and the list of all available trading instruments, while choosing a broker. The earlier trading starts, the better. The method described above indicates obvious benefits of trading binary options: a trader is released from responsibility for a subtle technical analysis so that he or she can analyze only natural impulses of the market. However, not all Binary brokers allow making the most of its potential. ….Did you like this article? Subscribe to new posts >>

Add your review