TABLE OF CONTENTS:

In the financial field, a contract for difference – or a CFD, as it is more widely known – is a legal contract between two parties – in this case described as ‘’buyer’’ and ‘’seller’’, that stipulates the seller will pay to the buyer the difference between the current value of a given asset, as well as its value at contract time.

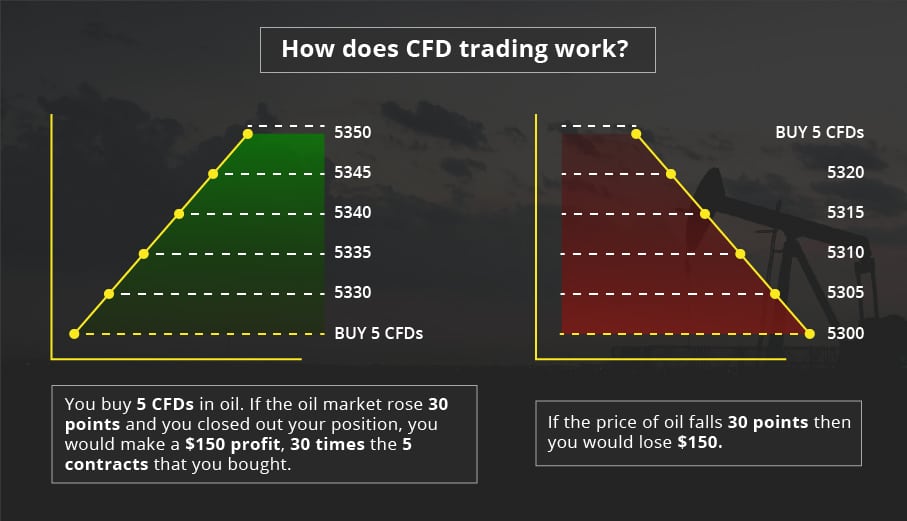

As convoluted as this might sound, CFDs are simply contracts that allow traders to take advantage of asset prices moving in one direction on the other – upwards, or long positions as well as downwards, or short positions. In effect, a CFD is a great opportunity for investors and traders to make profits on various price movements without actually owning the respective asset. It is actually a very simple contractual agreement, and everybody can try CFDs on major cryptocurrencies, as well as other assets such as stocks and bonds. Let us take a deeper look at how CFDs work.

The mechanism behind CFDs is actually very simple to understand. CFD’s are quotes in two prices: the buy price, and the sell price respectively.

Since sell prices will always be slightly lower than the market price, and the buy prices will be slightly higher in turn, the difference between these two opposed prices is called the spread.

Further on, CFD’s are usually traded in standardized contracts, which are also called lots. Now, the size of the lot depends on each individual contract, and it is mainly influenced by the intrinsic value of the asset that is being traded. For instance, silver is traded on commodity exchanges on lots as big as 5000 troy ounces – consequently, its equivalent CFD contract value is equal.

Let us take a look at another example. Say, a stock’s asking price is $25,26. If the trader buys 100 shares, the cost of the transaction should equal $2,526, with commission and fees included. While a traditional broker will require at least $1,263 in free cash for a trade, a broker under a CFD contractual obligation will require just 5 % margin.

This sounds very complicated at first, but it is very easy to understand once you grasp the basics. Now, let us take a look at some advantages of CFD to put all this information into perspective.

CFD brokers offer mainly the same service as traditional brokers – stops, limits, contingent orders, and so on and so forth. Some brokers even offer traders guaranteed stops by charging a certain fee for the service, or reimburse the trader. Similarly, CFD brokers make their living by taking a certain percentage from the spread, with absolutely no fees involved. Of course, the spread can vary in size depending on the market realities.

At their core, CFDs are highly flexible instruments that allow traders to take positions – whether long or short- on both sides of a certain transaction. If the trader finds out that the asset (currency pair, bonds, etc) is about to fall, they can quickly jump in the opposite camp and profit as if that were their position in the first place.

Another related advantage is that CFDs facilitate speculating on a wider variety of markets that are either too complex or too tricky to facilitate easy direct trading. The implication here is that by trading with a CFD, traders can manage bigger portfolios without worrying too much about the consequences.

While some markets are traditionally more liquid than others (we are talking, of course, about forex vs the stocks market), liquidy is still an important factor to consider when trading. No matter what you are buying or trading, you can’t make any money if there is no market for your product. The CFD market is highly liquid because it focuses mainly on the underlying asset market, meaning traders can focus their attention on shorter investment cycles without negatively affecting their chances of yielding a profit.

While certain markets set a limited amount of capital for day trading or set restrictions in terms of the amount of day trades that can be executed within certain accounts, the CFD market is not legally bound by these restrictions. Therefore, all individuals participating on the CFD market can trade as much as they wish, with no limits – accounts can be opened for as little as $1,000.

Due to the reasons stated above, and more, CFDs are more tax efficient. Whereas share transactions are liable to attract additional tax scrutiny, CFDs are exempt from it in many countries because, essentially, there is no share transaction taking place. Furthermore, traders can access tax deductions, citing the costs of trading as a reason.

CFDs are a great opportunity for traders who like to take a more nontraditional approach to the trading market. While there are some disadvantages that we did not cover extensively – increased risk due to leverage, lax industry regulation in some countries -, the pros clearly outweigh the cons if traders exercise caution and invest smartly.

Risk Disclaimer: “CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.“.

Add your review