TABLE OF CONTENTS:

We all heard the phrase that says, “Forex is the most liquid market”.

What does it mean? What is liquidity? What kind of risks does low liquidity carry? What about the liquidity inside your broker?

We are going to consider all these issues in the article in more details.

Availability of liquidity in the financial markets gives you plenty of benefits. If the benefits are not obvious for you, you may ask for opinion of any man who tried to sell a real estate during the financial crisis of 2008 or a trader who had a position opened in the wrong direction during a non-trading period before an important news release that triggered the trend reversal eventually. They found themselves in a situation, where they could not close their trades, when and where they wanted to: all this was due to the low market liquidity.

Liquidity is a possibility to “LIQUIDate” an asset quickly and without affecting its price dramatically. In other words, it can be characterized as an availability of the high level of demand and supply.

Imagine that you have Iphone, which you need to sell. Since Iphone is an extremely popular smartphone, it can be sold very easily. Also take notice that you will not have to cut its price very much (provided that the Iphone is used), because it will be quickly jumped at. Therefore, we conclude that Iphone is a liquid product: it can be easily bought and sold thanks to a lot of sellers and buyers.

Now try to imagine that you have your grandmother’s old wardrobe covered in chipped paint, with squeaking doors and cracks from long usage. Will it be easy for you to sell it? I’m not sure. You will more likely have to cut its price significantly. Is the wardrobe a liquid product? Of course, not. There are sellers, but buyers are significantly fewer. Besides, you will have to decrease your price. As you can see, there is an obvious unavailability of liquidity in the “Market of grandmother’s wardrobes”.

Let’s go back to the currency market ))

First of all, liquidity reflects the interests of market participants both in terms of an absolute number of traders and a total trading volume per unit of time. In other words, availability of a large volume of demand and supply is typical for the highly liquid market. The higher is the market liquidity, the faster one can liquidate a large position.

From an ordinary trader’s point of view, the value of liquidity is often measured in terms of volatility change. Price moves gradually and in small steps, and quotes are more consistent in the highly liquid market. EURUSD is one of the most liquid currency pairs and thereby we can see an almost ideally smooth price movement on the chart in spite of a small time frame.

Some of the most liquid currency pairs include: GBPUSD, USDJPY, USDCAD, USDCHF, AUDUSD, NZDUSD, GBPJPY, and EURJPY.

Decrease of the liquidity will result in significant up and down price moves and breaks in the quotes flow. The number of Buy and Sell orders might change by several times during this period, while remaining at the low level in absolute terms. In other words, the situation, where a financial instrument continues to depreciate and cannot be sold fully in any way, may happen.

Forex is referred to as the most liquid market in principle. But it doesn’t mean at all that currencies are not sensitive to the influence of liquidity: this factor must be taken into account even by Forex traders. Except for this, high liquidity in Forex trading often becomes a nice surprise for those who have come here from other markets. It is estimated that the daily Forex volume amounts to about $5 trillion.

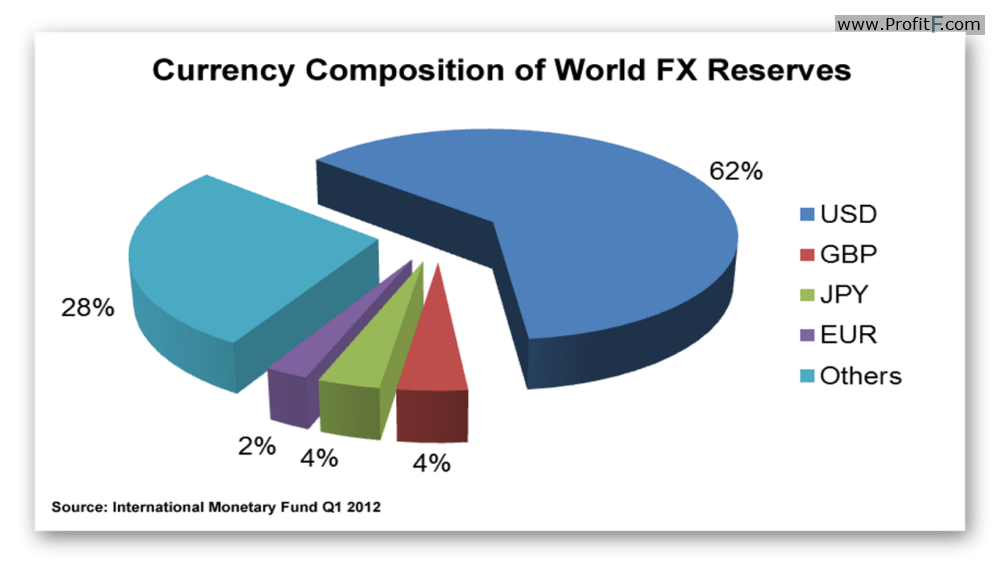

Global trading continually needs a large volume of currency exchange: this is the reason for such huge trading volumes. It is not surprising that money is the most liquid asset, since they can be immediately exchanged for goods, services and other benefits. Nowadays US dollar is in the greatest demand as compared to other currencies. To begin with, it is included in all major currency pairs, which accounts for 75% of all Forex trades. This is why one should certainly take into consideration the dollar.

High liquidity doesn’t mean high volatility: the market may be both liquid and poorly volatile.

As it was mentioned previously, the liquid market moves more smoothly, and low liquidity means a large number of random moves and more chaos. One of the reasons for sharp price surges (“spikes”) in both directions during high-impact news releases is the absence of liquidity providers, which simply don’t want to risk at this time by offsetting positions over releases of the news. (see our calendar of important news in Forex here >> )

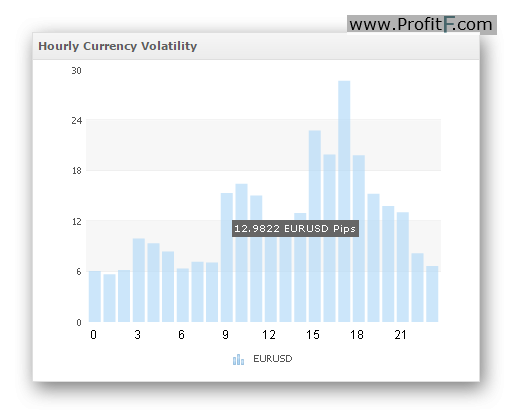

Liquidity in the Forex market varies throughout a trading day due to the fact that primary financial centers start its operation in different time zones of the world. As you know, low liquidity can be seen during the Asian session. However, financial reports published by Japanese companies and comments from local officials can trigger a rather strong market response, simply because a smaller market driving force will fight against a directional movement of changed sentiment.

In turn, peak liquidity can be observed at the opening of the European trading session and, in particular, the London session. The market activity rises gradually over the period of the European session, until North America-based market participants come into play. Liquidity falls sharply by the end of the European session and declines from the second half of the US session until the New York session close.

As was mentioned, the market is more vulnerable to unexpected and highly volatile price movements over the periods of low liquidity. News and rumors can act as catalysts that often cause sharp price spikes and gaps. It is extremely difficult to forecast price moves during these periods and thereby trading risks are also increased. If you have open positions, you should be always prepared for surprising increase of liquidity rate, while there is a low liquidity in the market.

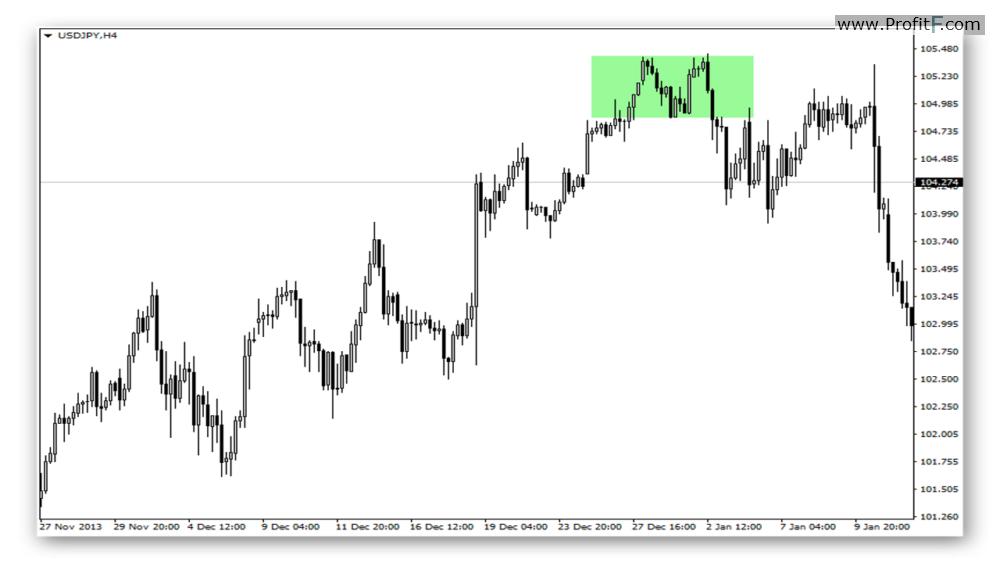

Liquidity can also significantly decrease because of holidays and changes in seasonal activity. For example, trading loses its activity by the end of the summer and before New Year holidays. As a rule, the market continues to move inertially within a predetermined channel during these “holiday” trading sessions.

The situation, where there are few participants left in the market, is referred to as the “thin market”. Large players can employ similar “weak points” to accelerate movements towards major key levels. In other words, the lower is liquidity, the easier is to “move” the market. Situations, where the market reverses its course completely after this congestion phase, are not rare.

Probably, you have noticed that the time required to close positions in the night-time may differ greatly from the one in the daytime; at that the market is often in a sideways state, i.e. it stands still. If you trade during the night sideways market, make sure that you have available economic calendar or customize economic news alerts. Remove all your positions from the chart an hour before high-impact news release so that you can protect your deposit against actions of major players.

One of the core benefits of Forex trading is a possibility of quick exchange. However, having a large amount of currency in hand, you can’t sell it fast during the period of low trading liquidity without incurring substantial losses in the form of trading costs. Besides, gaps often occur in the case of limited liquidity. Gap is a good thing, only when it occurs in the direction of your position(s). It is Sod’s law that a position usually goes far into the red after a gap occurrence.

If there are very few interested in buying a currency, liquidity will decline that affects trading conditions adversely: in particular, spread (the difference between the best Bid and Ask prices) is widening and the Order Book is emptying. On the contrary, if there is a high liquidity in the market, the spread is narrowing provided that your account type supports market execution.

Liquidity offered by a specific broker greatly depends on the number of connected providers. The more counterparties it cooperates with, the larger volume of orders they can process. Besides, a large number of orders affect spreads and execution speed favorably: the more orders are aggregated, the best prices it can offer eventually.

Large orders are executed exactly at requested prices in the highly liquid market. If there is enough trading volume at the next price, a trade will be executed without a slippage. For example Vantage Forex Broker

If there is not enough trading volume at the next price, the trade will be partially executed by matching it with every of the orders included in the volume, and the opening price will be calculated as a weighted average. In other words, the trade will be partially executed at 0.76237, 0.76238 and 0.76239, following which 0.76239 becomes the best next price.

Anyway, nobody is protected against unexpected spikes in volatilities. This is why you shouldn’t trust the market that appears to be a quiet and low liquid one at first sight – looks can be deceiving. High liquidity offers much more benefits making the market more suitable for technical analysis. The highly liquid market is also the strong market, where both opposite parties have almost equal powers, and one major player cannot have a strong impact on price movement.