Introduction to Grid Trading

The Grid trading is a type of trading strategy that profits from the sideways as well as trending market conditions. In the simplest of terms, Grid trading involves hedging, or placing simultaneous buy and sell orders at certain levels. The aim of this approach is to maximize the profits while the in-built hedging system ensures that the risks are minimized.

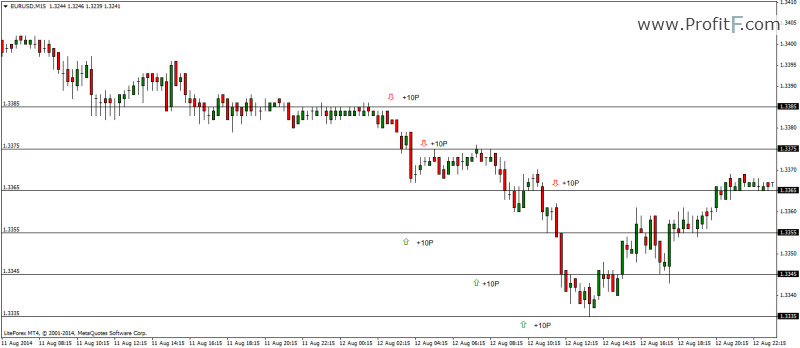

Grid trading typically requires a grid. The grid or levels can be based on a trader’s preference. For example, a 10 Pip grid with 5 levels could be used on EURUSD with Buy and Sell orders. The chart below shows one such example.

What we see in the above chart is 3 sell orders placed 10 pips away from each other and 3 buy orders placed 10 pips away from each other. As price enters the grid, it triggers the orders and continues to do so while booking profits of 30 pips on the way down. As price begins to reverse, the previously negative trades (buy orders) now start to move into profit capturing another 30 pips of profit, making a total of 60 pips with this simple grid based system. Assuming the stops for the sell orders were place 10 pips above the first grid level of 1.3385, at 1.3395, had price reversed from level 3 at 1.3365, the total loss incurred on this grid would have been 30, 20 and 10 pips or a total of 60 pips loss.

Depending on how price would have moved in the above grid, the amount of risk involved is usually offset by the grid levels and the hedged positions.

Why make use of a Grid trading system?

The Grid trading system is not recommended for all traders as it requires quite a bit of practice and can turn out to be risky if the trader does not understand how to use the grid. The grid based trading system can be used to maximize the returns from the trades. It can be especially usefully when price is in a ranging or consolidation pattern that is common before break outs.

The Grid trading system is merely a way of trading and is not to be misunderstood as a trading system that offers buy/sell signals.

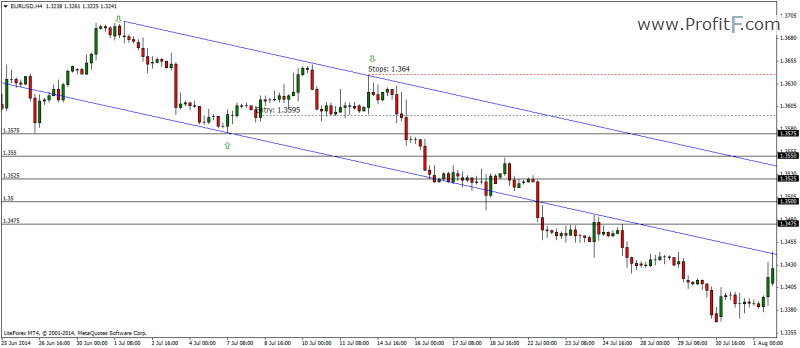

In many cases, a Grid based trading system is used in conjunction with other trading methods. The chart below illustrates how this is achieved. In the following chart, we make use of a simple channel trading method. After plotting a channel connecting the swing highs and lows, we see that price is in a downtrend and therefore, ideally we would be selling at the upper channel lines or when previous support lines are broken.

After the entry was triggered at 1.3595, with stops at 1.364, further sell orders would be placed 25 pips away with profits set to 25 Pips. In this method as price traveled from 1.3595, using the grid based trading system, the profits would have been:

| Level | Pips | Direction |

| 1 | 25 | Short |

| 2 | 25 | Short |

| 3 | 25 | Short |

| 4 | 25 | Short |

| 5 | 25 | Short |

Giving a total of 125 pips. Assuming the pip value here was $1, this grid based system would have given $125 in profit. If a single sell order was placed at the entry, the profit would have been only $120. Now if this grid was set up in a way with stops for all the orders placed at 1.364 and target price set at 1.3475, the results would have been:

| Trading Method | Profit |

| Simple Buy/Sell Entry | $120 |

| Grid Based (25 Pips) | $125 |

| Modified grid | $370 (120, 100, 75, 50, 25 pips respectively |

Although the results might look amazing, the risks with each of the above three approaches are also relative to the rewards. Therefore, the above example illustrates that grid trading requires some skill both in terms of trade analysis as well as risk management. Of course, in the above example, to mitigate the risks, Buy orders could be placed one level above in order to capture 25 pip moves in the event price reversed to move back up thus reducing the risk exposure.

Therefore, in this example, assuming price dropped to 3 levels and reversed from 1.3525, the total risked amount would have been 120 (level 1), 100 (level 2), 75 (level 3), a total of 295 pips. So if price reversed and moved to the upside, the buy orders would be triggered, thus reducing the exposure by 25, 50, 75, 100, 120, resulting in a break even trade.

Grid based trading system – Best uses

Although most articles speak of using a Grid based system within a consolidation pattern, due to the uncertainty involved, it can be a bit difficult to trade the Grid system within the consolidation. However, when the grid based system is used on break outs, they can quickly turn into massive profits based on the levels involved and the target price.

Traders should bear in mind that hedging is an important aspect of the grid based trading system and most brokers do not allow for hedging. It is therefore advisable for traders to check if their broker allows hedging. Another aspect to note is that the margin involved for hedge trading is significantly higher, so pay attention to your money management and equity.

Conclusion

In conclusion, hedge trading requires the skill of money management combined with a good technical trading system. It is highly recommended to first practice any grid based trading system on a demo account before attempting it on a real trading account.

Add your review