TABLE OF CONTENTS:

Interest Rate Decision Tutorial / How to Trade

Among the raft of economic data released each month (you can find it in Economic Calendar), few readings take on as much global importance as central bank meeting. Each month the individual central banks of the world meet to set rates for the month ahead, deciding whether to keep rates unchanged, raise them or lower them. These meeting, especially among G10 central banks, draw vast amounts of trader attention and have the ability to cause big market moves. The volatility around these events presents risk but also plenty of opportunity to traders who understand what to look for and how to position.

Before looking at how to trade these events we need to first of all develop a proper understanding of Interest rate decisions and their importance.

When determining how or whether to change interest rates, central banks consider a range of data from employment, inflation and growth through to broader issues such as political -stability and global issues.

The traditional relevance of interest rate decisions has been their ability determine the path of a currency. EXAMPLE: If the Bank of England raise rates, typically GBP will trade higher as the higher rate of return in the UK attracts foreign investment and causes Sterling to appreciate. Similarly, if the European Central Bank lower their rates, then investors will move money out of European looking for higher yield elsewhere.

So thinking about these two examples then, if the ECB cut rates we could expect EURGBP to drop as investors move money out of Europe and the UK sees capital inflow. Alongside thise fundamental flows these moves are also caused by speculative action such as traders selling EUR against GBP purely because they anticipate the pair will weaken based on the aforementioned reasons.

Therefore, when a central bank cuts rates traders should be looking to sell the currency of that particular economy. When choosing which pairs to trade it is key to look to seel the currency against an economy which has a higher interest rate or whose central bank is not forecast to cut rates. This divergence between central bank polices can create powerful trading opportunities. An example would be selling EURUAD when the ECB cut rates because Australia has one of the higher G10 interest rates.

However, it isn’t just the raising or lowering of rates that can have a big market impact. Sometimes, the decision by a central bank to keep rates on hold can drive just as much movement.

ECB meeting in December 2015

An example of this is the ECB meeting in December 2015 where the bank was largely expected to ease, or at least signal future easing. However, the bank refrained from easing and didn’t provide a clear signal of any forthcoming easing and the Euro rallied against USD by over 400 pips.

This brings us on to two key aspects of rates meetings

Alongside their decision each central bank also releases a statement on monetary policy which provides their latest basement of the economy and their outlook for the near term. Accordingly, these statement can be perceived as either Hawkish (suggesting rates will increase) or Dovish (suggesting rates will decrease) and can cause a lot of movement in markets.

If a central bank keeps their rates on hold but strikes a dovish tone, as we saw with the BOE’s July 2016 meeting where they gave a clear signal that they were likely to ease the following month, then typically the currency will still trade lower as we saw with GBP in response to that meeting. Hence, if the accompanying statement is seen as Dovish, traders should look to sell the currency expecting that the bank will soon move rates lower.

BOE’s July 2016 meeting

Alternatively, a central bank might opt to keep rates on hold but give firm guidance that a rate rise is likely in the coming months casing an increase in demand for the currency. This was quite often the case last year as the Fed seemed to be moving closer to moving rates up. Hence, if the accompanying statement is seen as Hawkish, traders should look to buy the currency expecting that the bank will soon move rates higher.

Rate decisions are not the only measures that can be employed at a rate meeting and banks can also implement asset purchase programmes known as quantitative easing whereby the bank looks to stimulate the economy through increased funding. The implementation of QE has traditionally resulted in a weaker currency as bond yields weaken as a result of the increased in buying.

The level of expectation in the market ahead of a central bank rate meeting has in recent times become perhaps the most important factor in determining how markets are affected.

If markets are widely expecting a central bank to cut rates or implement QE, or indeed simply give a firm signal that they are likely to ease in further meetings, then typically we see speculative traders building short positions ahead of the event. If the bank then fails to meet these expectations and refrains from easing and/or strikes a statement which isn’t as Dovish as expected, then we can see the currency trade higher as traders react with disappointment.

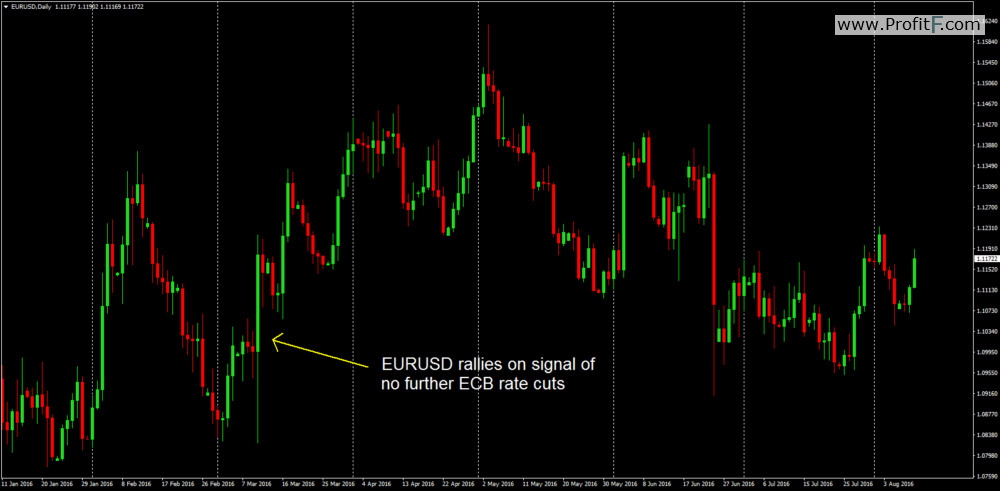

ECB cut rates in march 2016

A good example of this is when the ECB cut rates in march 2016 and EUR was initially weakening, however in the press conference afterward, ECB President Mario Draghi commented that he didn’t see rates being cut any lower in future. Markets took this as a sign that this would be the end of ECB rate cuts and EUR traded higher as shorts were cancelled.

Alternatively, if markets are expecting a central bank to raise rates, or indeed simply give a firm signal that rates are likely to be raised in further meetings, then typically we see traders building long positions ahead of the meeting. If the central bank then fails to satisfy these expectations either by refraining to raise rates and/or failing to give a signal that rates are likely to be raised in the near term, then we can see the currency fall lower as traders react with disappointment. During the summer last year there was a lot of expectation that the Fed would raise rates, however, as the Fed opted to keep rates on hold and sounded less convincing about the likelihood of near term rate hikes, as a result the US Dollar was sold.

The issue of market expectation is an important one because recently many central banks have been failing in pushing their currencies lower due to the fact that moves are so widely expected and positioning has already occurred well in advance of the meeting. This raises serious questions about the ability of central banks to drive currencies lower without seeking each time to beat market expectations.

Hopefully by now you have a much better understanding of the different ways in which rate decisions can affect markets and some of the key aspects to keep an eye out for. Leaning to understand and identify market expectations ahead of time can help you stay on the right side of the market and make money when others are losing it.

Add your review