TABLE OF CONTENTS:

Developing countries, such as China and India, come to the forefront in an era, when the European Union creaks at the seams and the future of the USA is vague. We, being Forex traders, are mostly interested in their currencies. Let’s consider the Indian rupee.

USDINR pair reflects a comparison of the US dollar to the Indian rupee. The pair has some unique features, so it is of considerable interest to us as a trading instrument. Below you’ll learn what nuances you should know, while trading this exotic instrument.

The population of India is increasing more rapidly than that of China, and, as a whole, the growth rate of the Celestial Empire economy is already losing pace against its Eastern brethren a little.

Given that population of India is 1.25 billion people and its economy is the fourth largest in the world, we shall see results of its active economy growth in the future. India came up the long way, during which it made a revolution in the agriculture sector. After seventy years since the declaration of its independence the country turned from the one chronically dependent on grain imports into net exporter of food products.

During this period the average life expectancy nearly doubled, the literacy rate increased by four times, and the strata of middle class increased considerably. At present time India is a home country for many pharmaceutical companies and also sectors of information and space technologies. All these factors increase the importance of India in the international scene. At the end of 2015, foreign companies invested about $26.5 billion in India and it is 18% more than in the previous year.

Today India ranks third in terms of GDP after the USA and China. Its main exports include software, jewelry products, agricultural products, pharmaceuticals, textiles and automotive industry products.

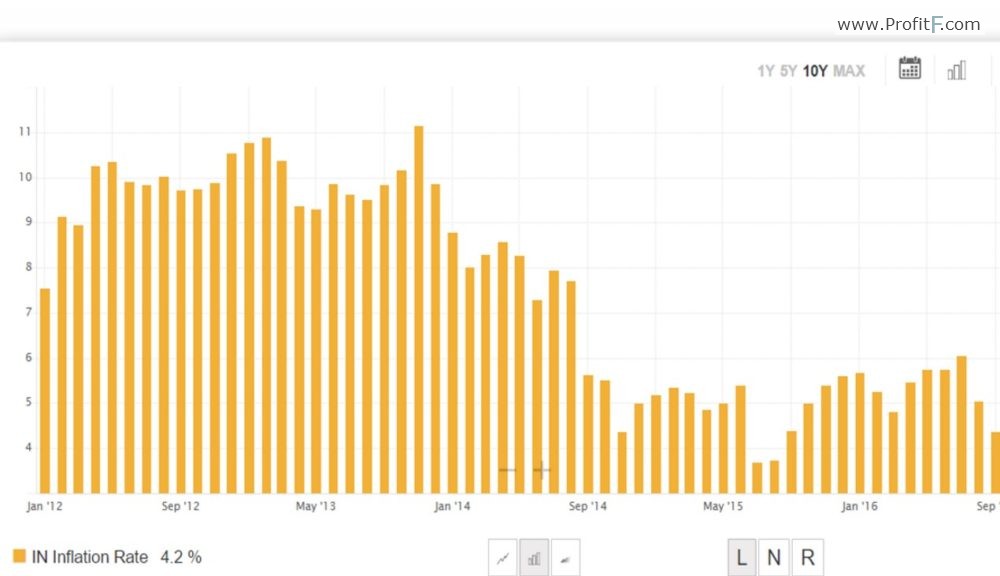

Being a large oil consumer, a cheap price for oil is extremely favorable for India. Oil imports increased by more than 50% over 10 years, and collapse in oil prices had a positive effect on restraining the growth in inflation rates. India occupies the fourth place in terms of oil consumption level, which is lower than that of USA, China, and Japan only.

Demographic analysis states that India will have the youngest labor power by 2020 and consequently a huge market of consumers. China, where the average age of population is still on the increase, can be taken as an example. Favorable demographic situation and low per capita income play a role of a catalyst for fast economic growth.

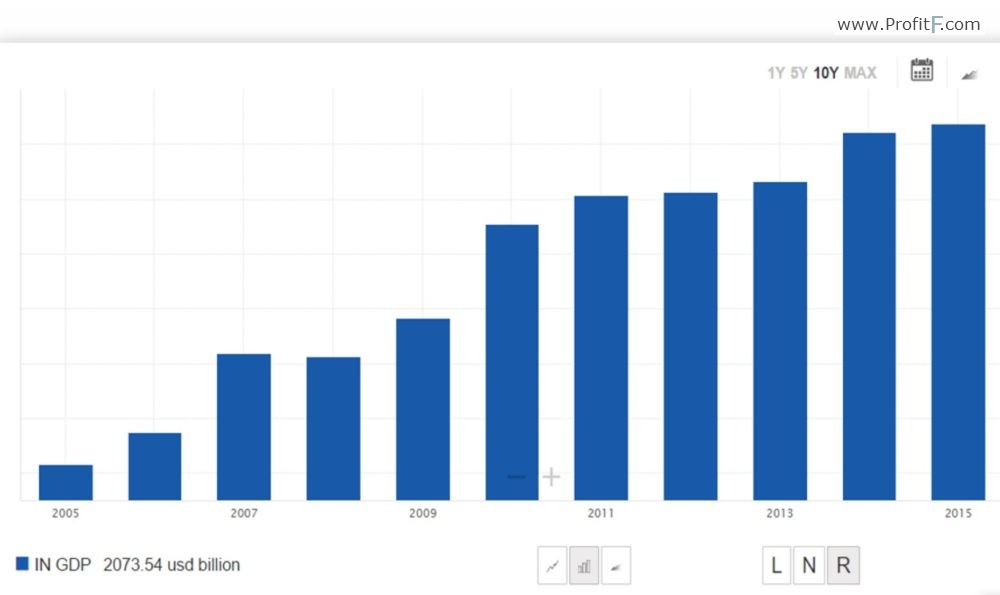

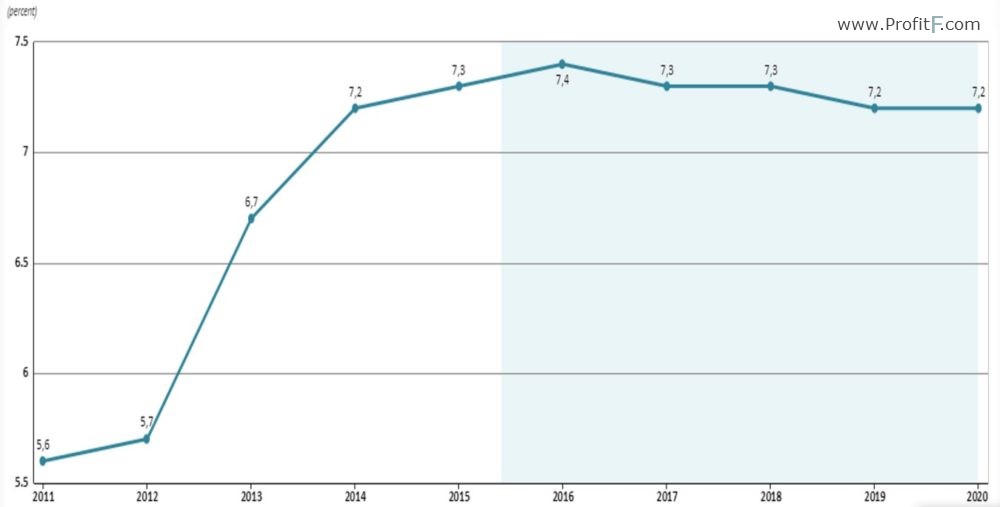

GDP is seen as a main indicator reflecting the state of national economy. After the average annual growth of 6.3% during three decades a period of stagnation began in 2011. Nowadays India is demonstrating the strongest growth among countries in the Asian-Pacific region: its annual growth rate might hit 6-7%, if not more, during the next five years.

Therefore, the India’s economy is one of the fastest growing and dominates compared to the developing markets. Its GDP rose by 7.3% in 2015 and is ready to rise by another 7.6% at the end of 2016 financial year. The results show that India is outpacing China in terms of GDP figures, which is one of the largest economies in the world.

However, according to US government report, more than 7% increase in annual growth of India’s GDP in 2015-2016 is actually overestimated. This is partially because this method of calculation of macroeconomic indicators has been adjusted very recently. Thus, accuracy of these values is in doubt given that industry and services sectors’ growth have been slowing down lately and information technology sector, which accounts for only quarter of GDP, will play a major role in the future.

According to various calculations, India is expected to see a gradual weakening of growth in the nearest decade. Taking into account a natural cyclicity of economy recovery periods, India is on the very threshold of new growth wave. It is partially due to its central bank actions resulted in interest rate cut and decrease of the inflation level and also improvement of corporate earnings.

The Indian rupee was introduced in 1542. The currency survived a great number of reshapings and changes of standards over its lifetime. At the moment 5, 10, 20, 50, 100, 500 and 1,000 rupee denomination notes are in circulation. The Reserve Bank of India is responsible for their issue. It is noticeable that one Indian rupee is almost equal to one Russian ruble nowadays.

The Indian rupee was introduced in 1542. The currency survived a great number of reshapings and changes of standards over its lifetime. At the moment 5, 10, 20, 50, 100, 500 and 1,000 rupee denomination notes are in circulation. The Reserve Bank of India is responsible for their issue. It is noticeable that one Indian rupee is almost equal to one Russian ruble nowadays.

The Reserve Bank of India, which exercises functions of a central bank, was established in 1934 and started its activity a year later. It is located in Mumbai, a financial capital of India. The bank supervises issue of currency, regulates a national banking system, i.e. exercises functions of a central bank.

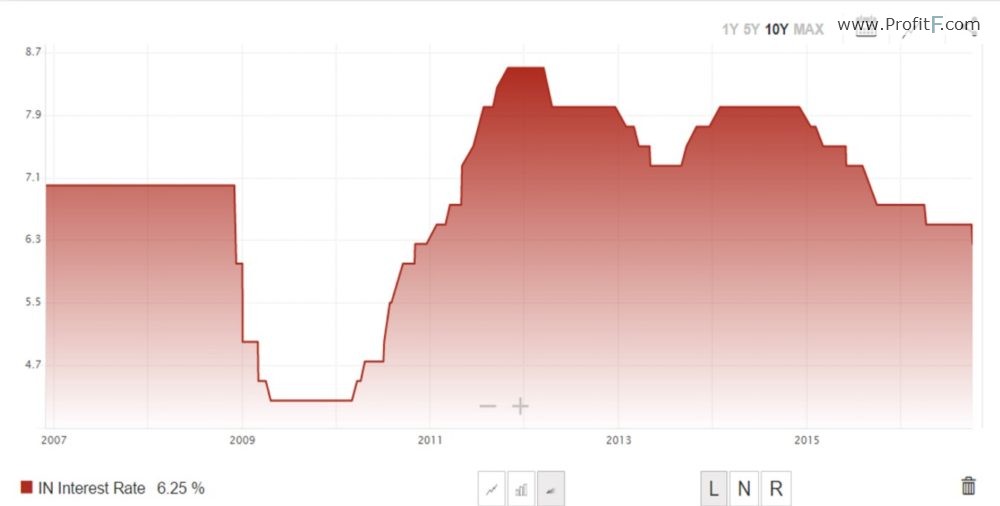

At October 4 meeting it was agreed to continue cutting interest rates by lowering a repo rate from 6.50% to 6.25% and thereby going back to the level of 2010. It was the first decision taken by the new Committee on monetary policy headed by Urjit Patel, its new governor, who took the position this September.

The Reserve Bank of India has been pursuing the policy of lowering interest rates since January 2015. The intentional lowering favored a considerable depreciation of the national currency against the US dollar. In turn, the currency devaluation caused an outflow of capital from the country. Currently the central bank has to strike a balance between boosting economy growth and lowering a pressure on the national currency.

In fact, reforms were initiated by the central bank in order to make a voting process more transparent and take opinions of all six members of the committee into consideration during a voting. The right of casting vote belonged to the central bank governor earlier.

The fact of cutting interest rates itself is aimed at achieving the target inflation rate of 5%. The decision on the cutting wouldn’t be so convincing, if the recent measures facilitating a decrease of the inflation level in the food industry haven’t been taken.

The Reserve Bank will more likely follow the policy of further interest rates cut.

In any case future of interest rates now depends on decision of the committee now, but not directly on the central bank. The only major task of the central bank is currently a control for consumer inflation. Allocation of tasks in this way must ensure a more stable monetary policy based on taking more predictable and deliberate decisions.

Prime minister announced on 9 November 2016 that all 500 and 1,000 rupee denomination notes were taken out of circulation. The authorities declared a deadline until the end of this year, when all old notes must be exchanged for lower value notes or new 500 and 2,000 rupee denomination notes. The measure was taken, first of all, to deal with corruption problems, since the exchange can be made for holders of declared income only by showing identification document and certificate of tax payment.

Therefore, essential part of notes in circulation shall be subject to exchange. To be more precise, the category of notes account for 24.4% of the total money turnover in the country and 86.4% of the entire money supply. The measures taken will more likely deprive both ordinary citizens and private sector of a portion of their profits for several coming months. These measures are intended to help solve problems associated with corruption and the growing market of “black” money in the long-run.

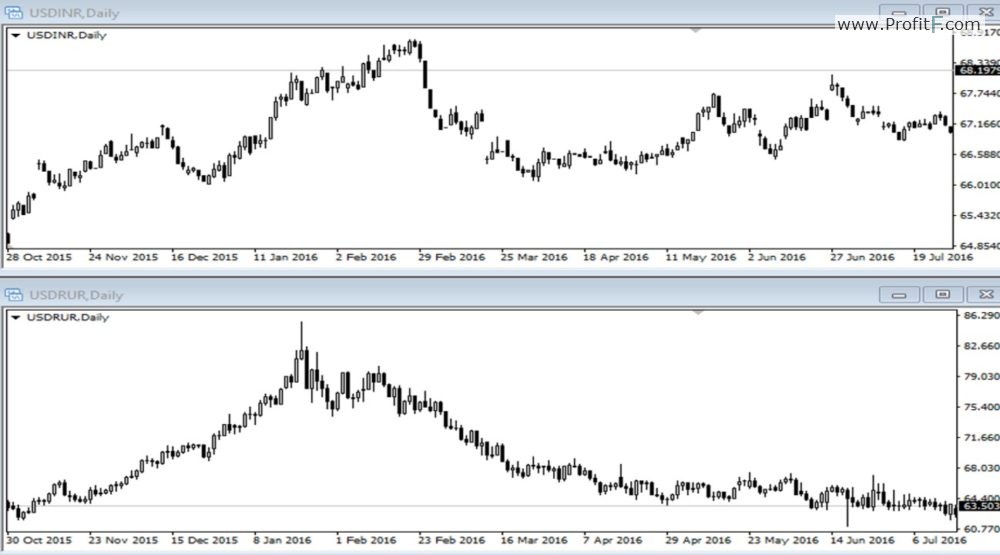

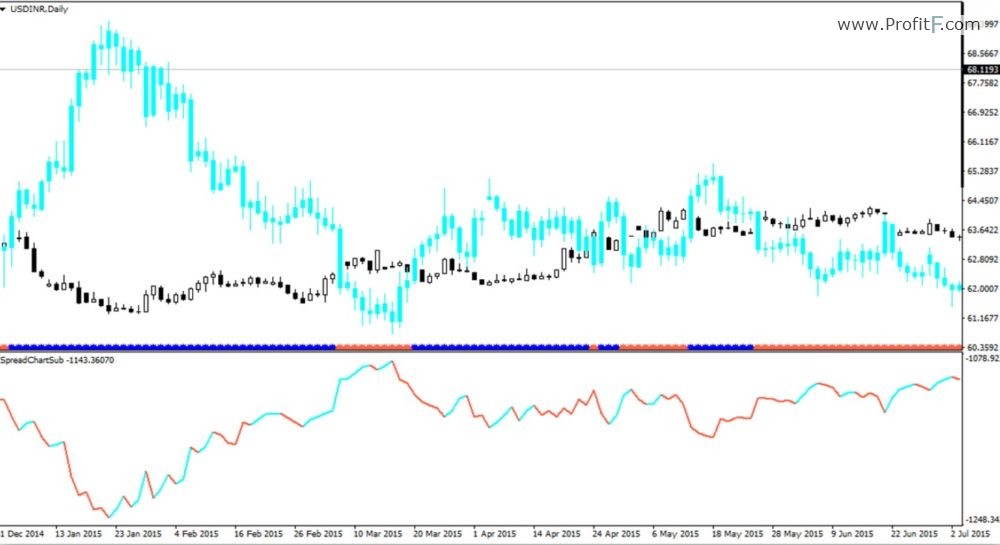

At the moment USDINR gains have slowed down a little. However, if we look back at its history, the global trend on its chart indicates that the pair is growing.

USDINR chart looks much like USDRUB chart. Movements of the pairs resemble each other very much: there are the same interrupted moves of price quotes and a common global trend. The same trading strategies can be applied to both pairs with reservations.

The only large brokerage company, which enables trading USDINR now, is InstaForex. (see other Forex brokers here >>) Swaps equal to -40 points. The pair is traded using quotes with three decimal places, and the point value is 10 times less than with the EURUSD. In other words, although the swaps are negative, but their size is small enough not to pay much attention to them. Hours of trading the pair are limited. Trading session for USDINR starts at 7:35 a.m. and ends at 3:30 p.m. Moscow time.

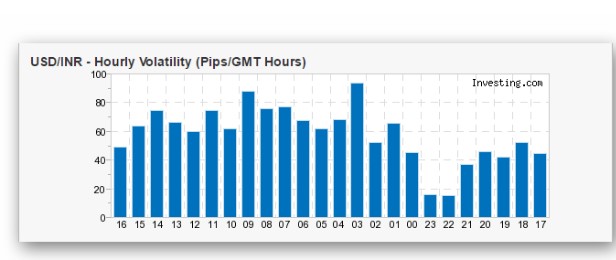

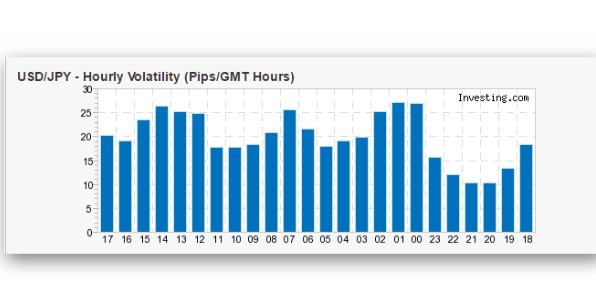

USDINR have a volatility level comparable with that of EURUSD, but twice less than that of USDJPY. The average weekly volatility level is 6% for rupee and 11% for yen. Although the pair is traded relatively quietly, it sharply responds to news events: this fact might lead to large price gaps in the case of limited liquidity.

Its trading activity is equally allocated among Asian and European sessions. At that, trading through European session is more consistent, but a peak of volatility falls on Asian session.

As a whole, USDJPY behavior is similar to USDINR. Trading in the pair also becomes less active at the end of U.S. session. Afterwards, the pair is very slowly traded from about 9:00 p.m. to 3:00 a.m. Moscow time.

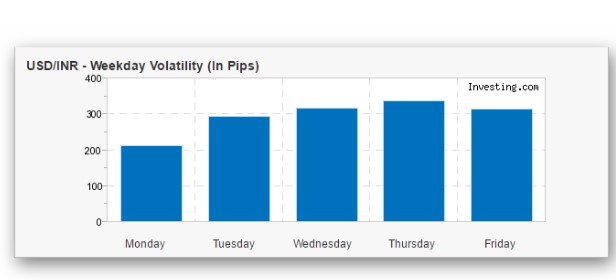

Weekly volatility increases from Monday till Friday. Therefore, the strongest movements occur in the second half of a week – the pair needs time to “speed up”.

Let’s try to analyze a seasonal volatility of the pair over the last 2 years. If USDJPY is more actively traded in a spring period, USDINR’s trading activity is the most actively in a summer period and gradually slows down towards an autumn. As for the rest seasons, the pair’s behavior is rather steady without any abnormal surges.

Emerging market currencies have one interesting feature, and not all traders take it into account. The world financial market is cyclical and even the leading countries experience effects of recession from time to time. However, economy recovers over time again, and relative value of major pairs increases. The opposite is true for exotic pairs: the rupee pulls USD dollar down and is affected by effects of the world economy recovery.

Given that USDINR is rather specific and even puts up an essential resistance to USD dollar, USDINR suits well for diversification of risks. You can achieve a more smoothed growth of profit and reduce drawdowns by trading your equity curve, if you add USDINR to your trading system’s portfolio.

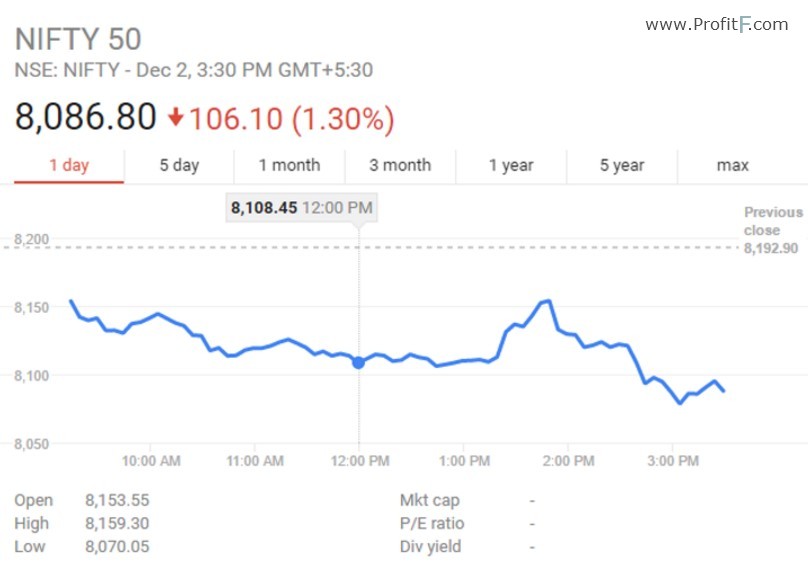

The pair has a rather strong inverse correlation with NIFTY 50 – India’s stock market index. When the stock market falls, USDINR rises, and vice versa.

It is also worth to note that USDINR is strongly correlated with precious metals: in particular, USDINR has a strong inverse correlation with gold (XAUUSD). You can also reduce your trading risks by opening one-directional positions for both instruments simultaneously. Pair trading strategy is applicable here: two positions are opened in the opposite directions whilst spread widens.

We have a strong support level at 67, which the pair might want to test before it will continue to rise. We enter only a Buy trade, when the level is broken above.

If the pair continues going higher, you should target long-term channel boundaries, which the price already came out in the spring of 2013 and came back inside it a year later.

USDINR is rather vulnerable to news events. At that the pair is mostly affected by the same news as USD dollar. This is why we should take into consideration all the news highlighted in red and related to election races, Fed’s decisions and heavy-hitting economic reports, while trading.

Try to avoid opening Sell positions and monitor potential Buy trades only. You mustn’t ignore long-term channels and key levels on daily charts. The fact that formation of gaps on USDINR charts is normal and they close not always should also be considered.

Nowadays USDINR is an absolutely specific instrument that can be judged by its moderate response to US presidential election. Based on a solid potential of India’s economy, the pair will fit very well into a ready-made diversification portfolio. As a whole, USDINR is better suitable for position trading allowing for stable trends and formation of long-term channels. The same is true for its correlation with precious metals that is characterized by long-run interrelation.

Add your review