XYZ-Breakout – Breakout trading strategy is one of the simplest trading methods when it comes to using the concept of trading break outs. The 1-2-3 method is basically a measured move trading set up, where future price is projected based on past retracements. It is also referred to as the “X-Y-Z” pattern.

Strategy Set up

This trading strategy is pure price action and therefore no indicators are required. For those who do need help, using a Fibonacci tool can be helpful.

Recommended Broker >>

XYZ Breakout Strategy Rules

Long Set up:

- In an uptrend, “X” marks the start of an uptrend, which is usually strong

- The “Y” marks a resistance level which shows the start of a retracement. The retracement is usually limited to 38.2 – 50%

- The retracement end marks the point “Z”

- Buy on break of point “Y” with a 1:1 risk reward ratio with stop loss placed just below the point “Z”

Short Set up:

- In a downtrend, “X” marks the starts of a downtrend which is strong

- The “Y” point marks a support level that starts a retracement. The retracement is limited to between 38.2% – and 50% Fib level

- The retracement ends the point “Z”

- Sell on break of “Y” with stops just below “Z” and a total risk reward of 1:1

Strategy Examples

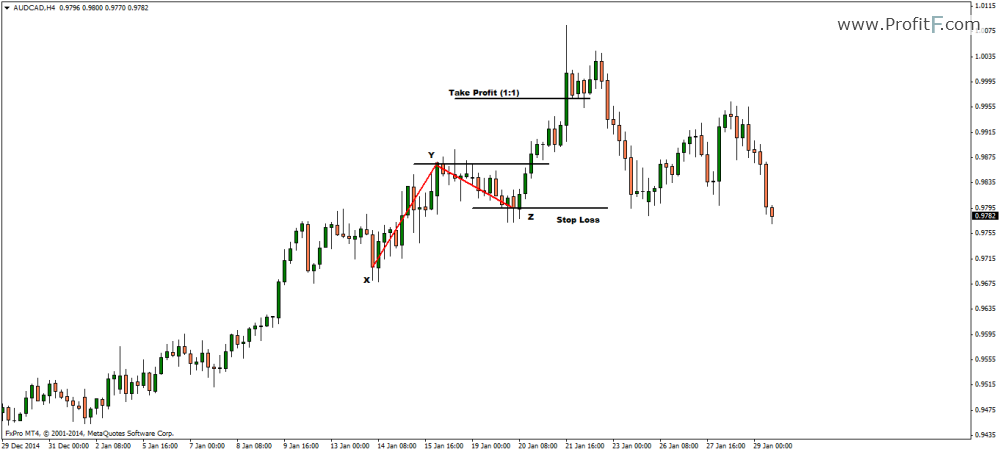

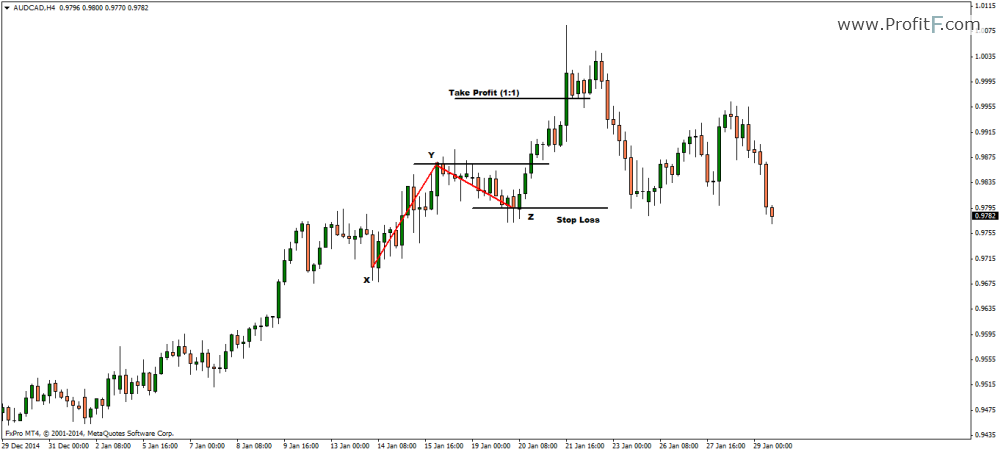

Long Set Up

- Point XY marks the strong uptrend before the retracement

- Z marks the end of retracement

- A long position is take at Y with a 1:1 Risk reward

- Stops are placed a few pips below “Z” with the trade resulting in a profit

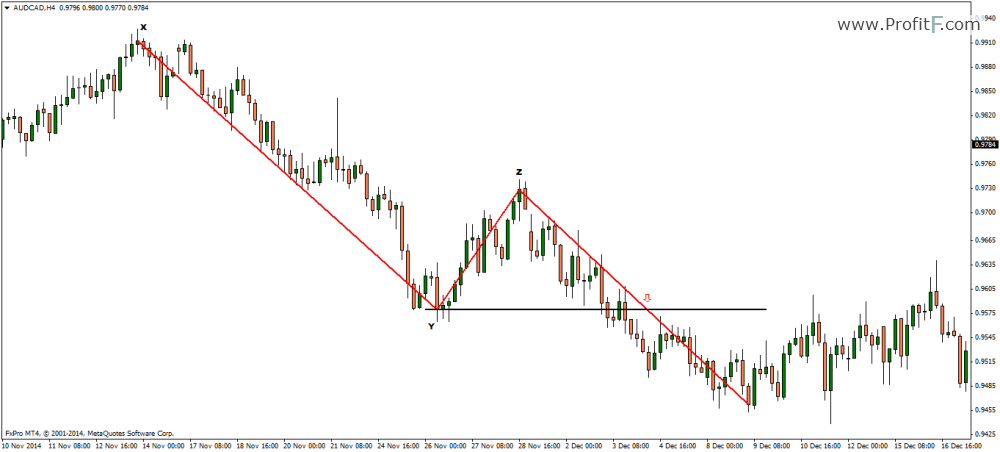

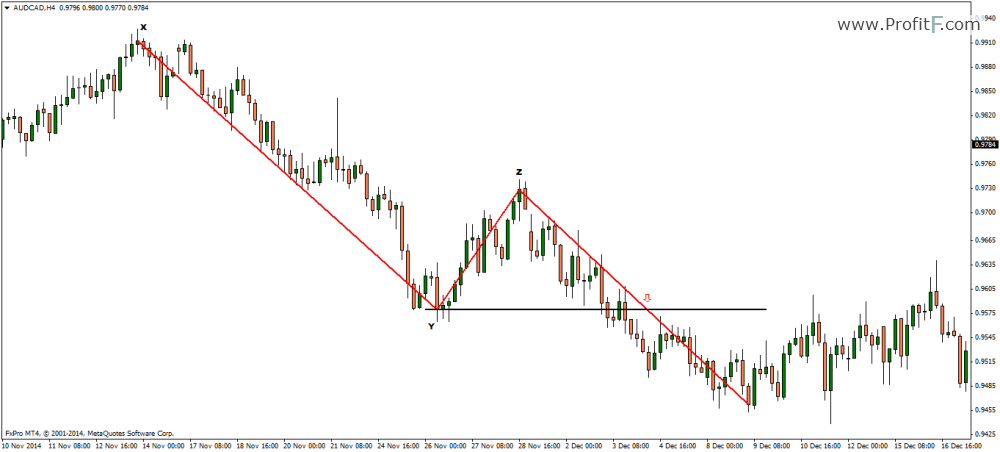

Short Set up

- Point XY marks the strong down trend with Z showing the end of the retracement

- A short position is taken on break of “Y” with a 1:1 Risk reward ratio

- Stops are placed just above “Z” with the trade resulting in a profit

Conclusion

The XYZ or 123 trading strategy is a relatively simple price action based breakout trading strategy. It works on the concept of measured moves and is a good way for beginners to learn to understand trading with support/resistance and break out.

Add your review