Explanation of forex drawdown, Forex drawdown meaning. What Is Drawdown in Forex?

Drawdown in forex is the difference between the account balance and the equity or is referred to as the peak to trough difference in equity. As one might know, the equity balance changes based on the open position’s P/L. When the equity balance drops below the account balance (i.e. when your equity is losing more than your balance) it is referred to as a drawdown. Drawdown measures the largest loss an account takes, therefore traders and investors should both pay attention to drawdown as it gives an overview on the loss taken by the account.

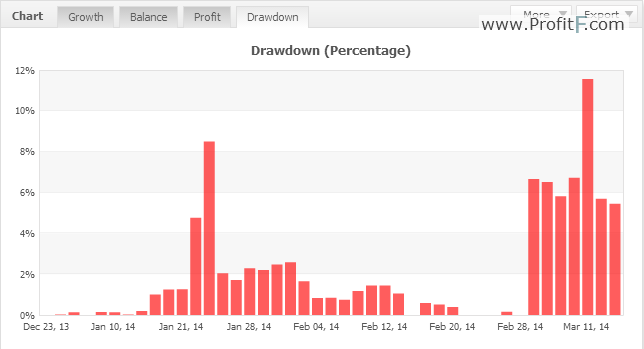

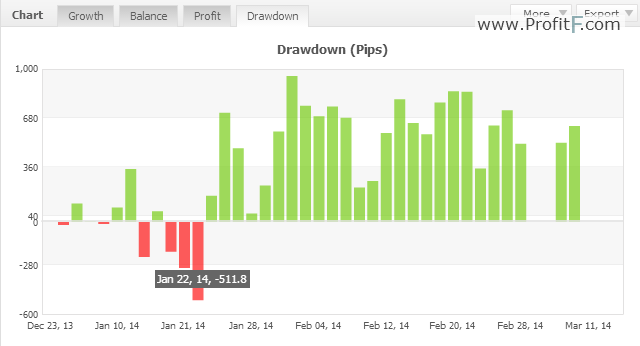

Drawdown can be represented in many ways; Percentages, Pips or in profits.

The chart below shows an 11% drawdown, represented in Percentages and Pips.

Figure 1: Drawdown in percentage

Figure 2: Drawdown in Pips

For traders, drawdown is used in reference to how well a trading system or strategy works, whereas for investors, drawdown is used to learn more about the maximum risk that a money manager or a fund can take thus helping them to make a more informed decision.

The simplest way to explain drawdown is when an account with equity of $1000 takes a loss of $500. Here, the drawdown is 50%. Which when translated to layman’s term is nothing but the fact that the account can lose as much as 50% of its value. Drawdown can also be illustrated differently. For example if a forex trading system states that it is 80% profitable, it translates to a 20% drawdown that the trading system will incur.

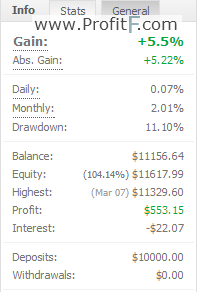

Figure 3: Drawdown – Trading System

In the above figure we notice that the trading system has a total gain of 5% but comes at the risk of an 11% drawdown. Just looking at the gain and the drawdown clearly tells you that the risks far outweigh the profits generated from this trading system and can thus warn an investor if it is worth investing in such as risky trading system or a fund.

Most traders tend to look for a trading system that can/will avoid drawdowns. However, this is a myth as any trading system will incur a drawdown. Even 1% at times and there is no way to avoid this. While drawdowns can be calculated manually, most forex analytics systems such myfxbook automatically does this for you.

Drawdown can help traders to identify if a trading system or method is profitable in relation to the risks associated with it. As a trader, drawdown therefore can tell you if you need to change the default contract sizes or if you have to completely overhaul your trading strategy. Drawdowns keep changing if a new peak or a trough is hit and therefore is not a constant but a variable that keeps changing throughout the lifespan of a trading system or a fund. It is for this reason; one commonly gets to hear the phrase that past performance is not indicative of future results.

As a general thumbrule, the lower the risk per trade the lower the drawdown will be but at the cost that growth or profit increases at a very slow pace. On the contrary, more risk you take, higher the forex drawdown and the profits will be.

The goal therefore for most traders or fund managers is to find a balance between risk and growth and this is where drawdowns are most helpful.

Add your review