Do you know why the Canadian currency is called the Loonie? Or why the Canadian dollar is one among the most popular commodity currency pairs traded? Do you want to know why the British were keen to make Pound Sterling the currency of Canada? Also that some form of paper currency was used in Canada as early as 1680. This article will give you all the details about the Canadian dollar from its interesting past to its present state.

The brief history of Canadian currencies

Canada has used a number of currencies over the last 500 years. They have used the copper, the silver and the gold coins, during its shortage denominations of money was written behind the playing cards and it was also used for a few years initially. Post that card money, paper treasury bills and paper money in other forms were used in the 18th century.

As there were a number of colonies in Canada, they have used the British pound, the US dollar, the Spanish dollar, dollar-denominated notes of Canada and various local currencies. The first bank notes in dollars were printed by the Montreal Bank in 1817. The British wanted to make the pound as the currency of Canada. However, due to the proximity to the US, active trade existed between the two. The dollars printed by Canada were widely being used in the US by traders of both sides. Shifting to a sterling denomination would have rendered the dollar useless. The cost of converting to the sterling-based system was high due to which the dollar was accepted as the currency of Canada.

Why is the Canadian currency called the ‘Loonie’

The Bank of Canada came into existence in 1934 and minted their first silver dollar called as the Voyageur dollar in 1935. The silver dollar was stamped to commemorate King George V’s Silver Jubilee. It showed the king on the front side and, on the back it showed a Voyageur and an Indian canoeing with two bundles of fur. The silver dollar had 80% silver and it continued till 1968, after which a smaller nickel dollar was stamped till 1986. The coin was not very popular probably because of its size and weight.

In the 1980s, it was suggested to replace the dollar bills and instead mint new coins as coins have a longer life than a dollar bill whose life was approximately a year. Though the size of the coin was to be changed, the same voyageur design was to be used. However, the set of dies depicting the design were lost in transit from Ottawa to Winnipeg.

On enquiry, it came to light that it was the third time the dies were lost in the last five years. Fearing counterfeiting, a new design was planned. The new design of the common loon, which is a popular bird in Canada floating on water was accepted and immediately became famous as the Loonie. The designer of the Loonie was Robert-Ralph Carmichael. Since then ‘Loonie’ is popularly used to denote the Canadian dollar. In 1996, the two dollar coin was minted and it came to be called as the Toonie, combined from the words two and loonie.

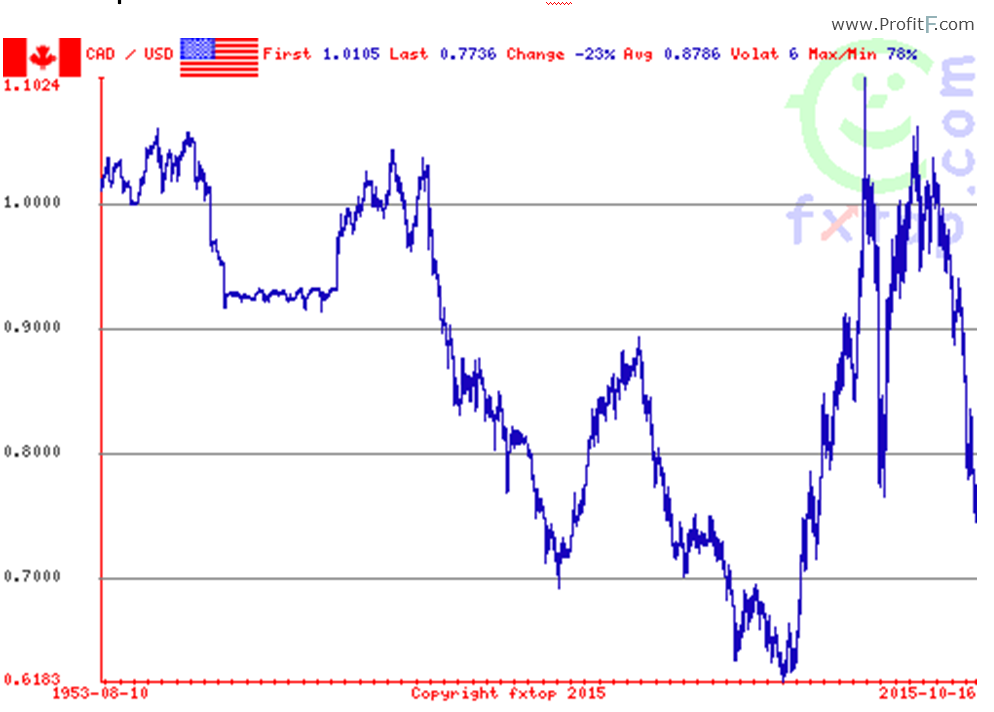

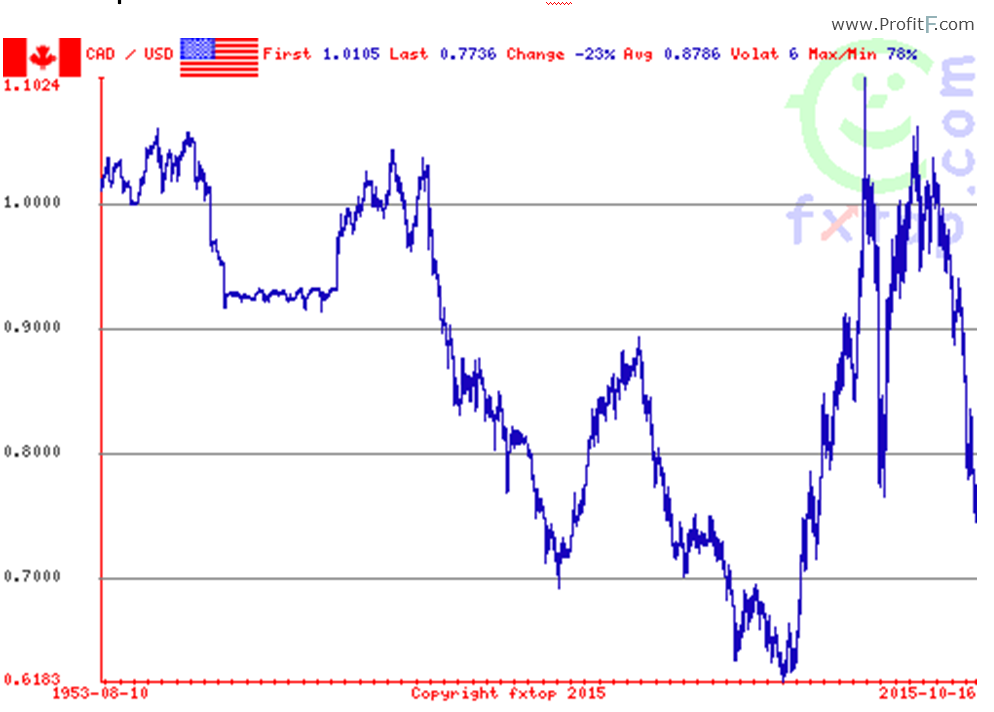

Historical performance of the Canadian dollar vs the US dollar

As seen from the chart above, for the period from 1953 to 1977, the CAD traded between 0.925 and 1.0614 to the US dollar. The downtrend started in 1976 and continued till 2002 when the CAD hit its all-time low of 0.6179.

Post that the price gave a sharp move up and in 2007 it crossed the highs of 1957, its fall started with the financial crisis and continued until 2009. Post the fall, price again rose close to the previous highs in 2011. And since then the prices are on a decline.

What could be reasons that the Canadian currency has seen some volatile moves in the last 15 years?

Fundamentals of Canadian Dollar

Canada is a resource-rich nation, having the second largest known reserves of oil after Saudi Arabia. It’s also the second largest Uranium producing country in the world. It is the seventh largest producer of Gold. However, it is the crude oil which affects the currency most.

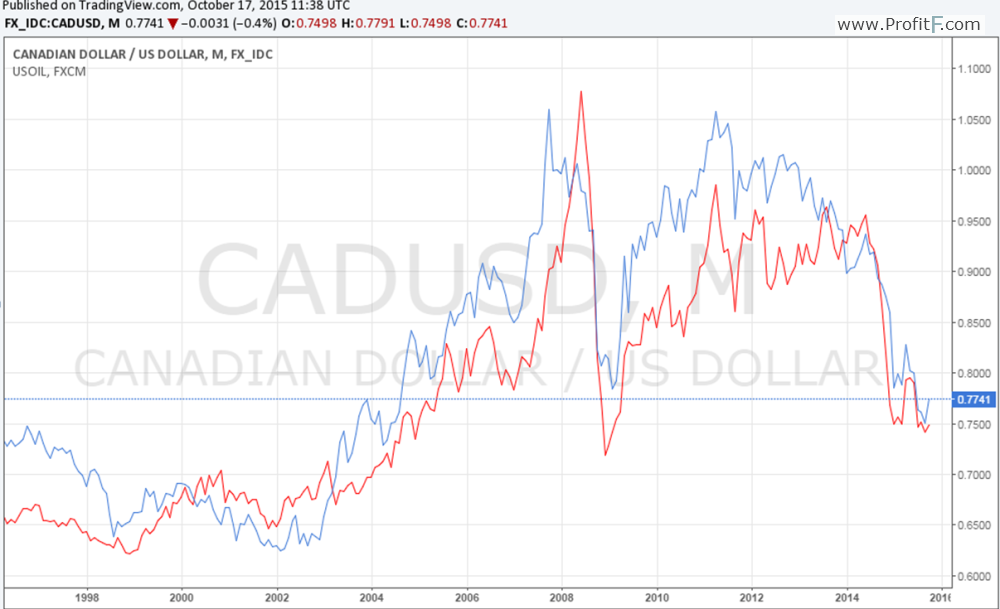

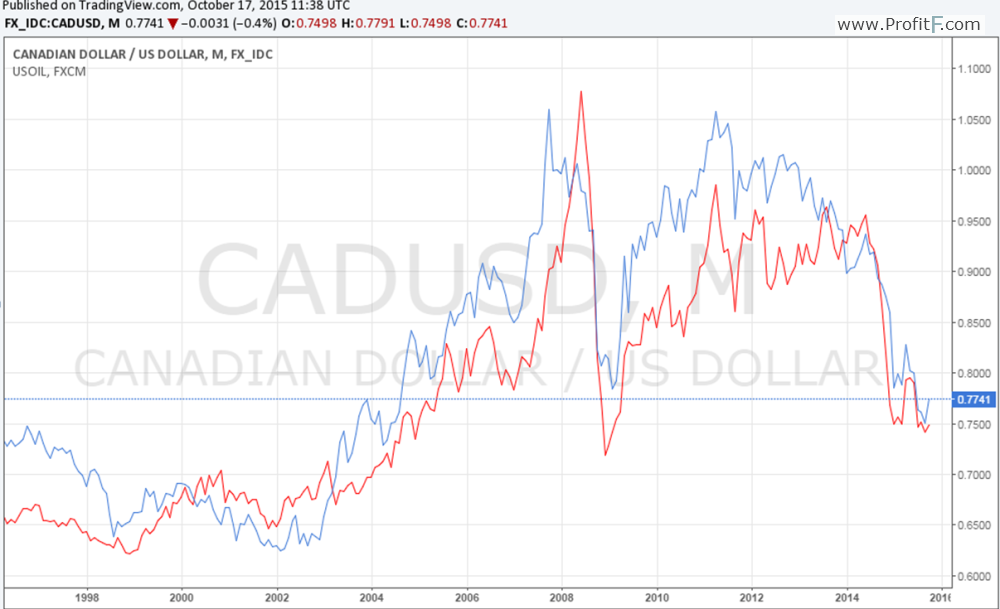

A comparative chart between the CAD and the US oil gives a clear picture to the extent the prices of oil correspond to the movement of the CAD.

As seen in the above chart, from around 1999 till now, the graphs of both the CAD and crude oil rise and fall in tandem. This shows the dependence of CAD on oil prices.

The crude oil production in Canada has risen from 609 million barrels annually in 1990 to 969 million barrels per annum in 2006 and is at 3.64 million barrels/day in the first half of this year, till June 2015. If oil prices were to recover, the production is likely to reach 6.7 million barrels per day by 2030. This clearly shows that the energy sector has grown rapidly outpacing the other industries in Canada.

The natural resources accounts for approximately 1.6 million jobs and is estimated to be 20% of the GDP of Canada. The oil sector alone is responsible for 11% of the economic output according to Government statistics.

According to Investopedia, exports contribute 72% of the current account receipts and mineral oil is the biggest foreign exchange earner. Oil earns approximately 15% of the total foreign exchange earnings by Canada. Canada exports 97% of its oil to the US and all the transactions are done in the US dollar. When the crude oil prices are high, the inflow of the US dollars is high, thereby demand is less due to which the Canadian dollar rises. On the contrary when the crude oil prices drop, fewer US dollar are earned by Canada, thereby increasing its demand causing the Canadian dollar to fall in value.

Conclusion

It is clear from the fundamentals of the Canadian economy that the reliance on oil in the last few years for exports, job creation has increased rapidly. With a dip in crude oil prices, large oil companies have cut back on their investments, the auxiliary industries supporting the oil industry are also facing the heat, and cost cuts are abundant all across the industry. This has led to unemployment rising to 7.1% in September.

Canada has a robust banking industry with a strong history and a well-educated workforce. The drop in oil prices might turn to be a boon to the other export oriented industry as it makes the Canadian exports competitive.

In the future, if Canada’s reliance on oil reduces, the Loonie might delink itself from crude oil prices, else the trend of positive correlation between the two is likely to continue.

Rakesh Upadhyay

Add your review