Order management is an important aspect that is essential to not just your trading style but also to managing risk better. While forex trading might look as simple as hitting the ‘Buy’ or ‘Sell’ order button and closing the trades on profits (or on losses); there many ways that a trader can approach the markets besides just clicking the button. In this article you will learn about the different ways to place forex orders as well as what each of these mean.

Forex orders can be classified into two main categories:

Market orders – What are these?

Market order is very common and something most would be familiar with if they have traded forex for a while. A market order is defined as the order to buy or sell a security at the current market price. This is as simple as hitting the buy or sell button. For example, if EURUSD was currently trading at 1.31051 (bid) and you want to buy, you simply place a market order by clicking the ‘Buy’ button. When your order is placed, it is nothing but a market order that is executed. Likewise, when you close your trade by clicking on ‘Close’ you place a market order to ‘Sell’ to close that previous buy position.

When is a market order useful?

Market orders are ideally used in fast moving markets and when you want to make a quick profit for a couple of pips. Therefore, market orders are usually preferred by scalpers or when you want to trade a news event and take advantage of a market that is set in a particular direction. Market orders help you to get in and out of trading quick and easy. So if your trading style is based on scalping or to make a few pips in profits, market orders are the most ideal type of orders to use. (Forex Scalping Definition)

Limit orders – What are these?

Limit orders are not that common and are generally used by experienced traders. A limit order is defined is as an order to buy or sell a security at a specific price. When placing a limit order, there is no guarantee that your order will be filled (executed). This is due to the nature that a limit order is only triggered when the price you mentioned is reached.

When is a limit order useful?

Limit orders are useful when you are trading long term, or on higher time frames and can also depend on your trading strategy and approach. Limit orders also usually carry a period of expiry. When placing limit orders, you can choose the GTC option (Good till cancelled) or End of day expiry (where the order expires by end of day). Alternatively, you can also specify a time period after which if the limit order is not reached it automatically expires.

While most swing traders make use of limit orders, some intra-day traders also use limit orders and it purely depends on the trading style and strategy that they follow.

Another benefit of using limit orders is that you do not have to sit in front of your charts waiting for price to reach your preferred level. You can just place a limit order and the order will be triggered whenever price reaches your limit order level.

Stop Orders – What are these?

Stop orders are usually used along with limit orders. As the name implies, a stop order is defined as an order to buy or sell (in other words: to close your trade) when price reaches the specified stop order level. Stop orders are also known as stop loss orders but also refer to take profit order. To better understand stop orders, let’s take the following example:

Buy 1 Lot of EURUSD, Limit order at 1.32 with stop orders at 1.325 and 1.31, GTC

So what does this mean?

You are buying 1 lot of EURUSD with a limit order at 1.32. The order is triggered only when EURUSD reaches 1.32 with no expiry as it is a Good-till-cancelled type of expiry. At the same time, you limit your profit and losses to 1.325 and 1.31. So if EURUSD reaches 1.32 and drops to 1.31 (where in you are in a losing trade); your stop order (stop loss order in this case) is triggered. Your trade is closed when price falls to 1.31.

Likewise, when price reaches 1.325, your stop order is triggered and gets you out of the market with 1000 pips in profit.

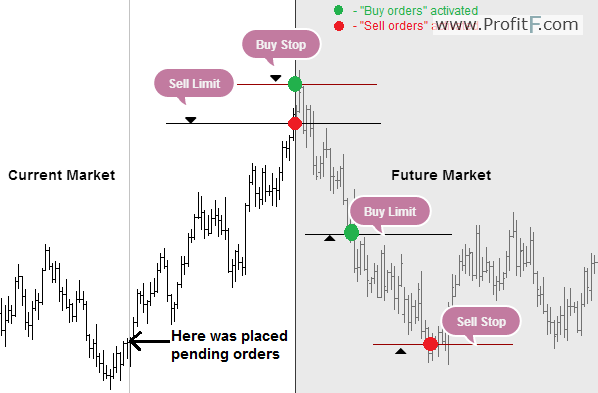

Here examples of Types of Forex orders : “Buy Limit”, “Sell Limit”, “Buy Stop”, “Sell Stop” orders:

Orders Types and Trading Strategies

The types of orders you use are usually dictated by a trading strategy that you are using. Some trading methods for example require you to place a limit order on a recent swing high or at the open or close of the previous candle. Similarly scalping strategies require you to trade based on price action and thus place orders at market.

If you are wondering which of the above two types of orders are better; the answer is both are good. It only depends on what your trading objective and style is. Stop orders are essential however and must be used regardless of the type of order that you use. Stop orders, especially stop loss orders prevent your capital from depreciating against any unexpected price moves and thus provide you with some capital to face the next trading day.

i have a confusion in your Buy and sell stop order.

will you clearify it.