Support and Resistance trading method. Lines. Levels, Strategies.

What is Support and Resistance?

Supply and Demand! One of the basic characteristics that determines the value of a product, commodity and even a currency, forms an important aspect when it comes to technical analysis of the forex markets. Prices in a currency pair tend to fluctuate when there is an imbalance of supply and demand. In this article, we’ll explain what supply and demand is and thus eventually illustrate the importance of trading with support and resistance and how traders can capitalize on this anomaly in order to take more effective trades.

What is supply and demand?

Supply is when there is an abundance of a product or when there are fewer buyers in a market. This scenario results in prices being reduced.

Demand, is when there is an abundance of buyers or when the availability of the product is much lesser, which tends to raise the value of the product.

Therefore, in forex terminology, when there are a lot of sellers, the price tends to drop and when there are many buyers, the price tends to rise.

Supply and demand, in trading terminology can also be referred to as support and resistance.

What is support in forex? Support is nothing but a level or a zone where there are more buyers than sellers, thus forming a floor and where price tends to rise in value. Resistance, in forex is where there are more sellers thus resulting in a drop in a price.

In simplistic terms, it is ideal to sell at resistance (or supply levels) and to buy at support (demand levels).

Support and resistance form an important aspect of trading the forex markets. They are not constant and continue to change constantly as the market dynamics continue to change. Understanding support and resistance is an important concept in trading and it is essential for the trader to understand these concepts.

Support and resistance levels can assist in various forms of trading, the most common trading systems of which are as follows:

To understand any of the above, we need to first get an idea of how support and resistance levels are depicted in the charts.

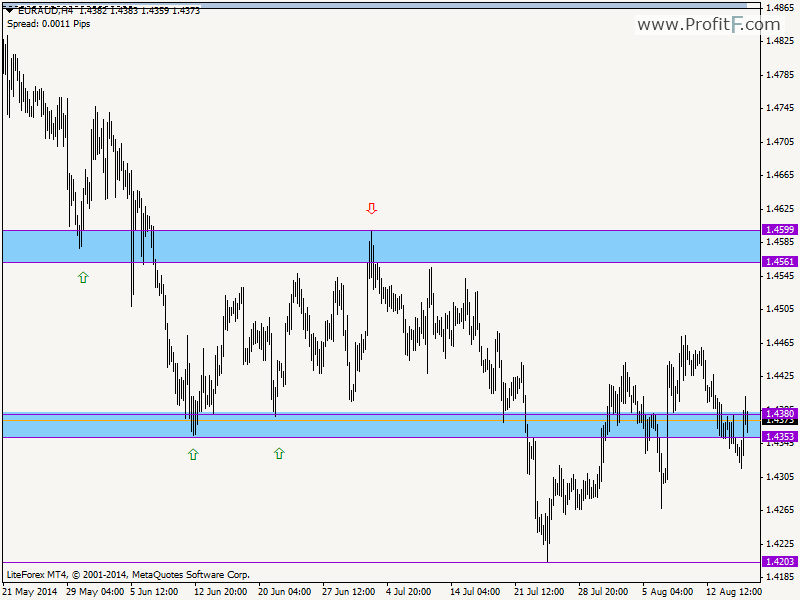

In the chart above, notice the highlighted areas depict support and resistance, with the red and green arrows. Take note of the green arrows depicting the support level where price has managed to rally twice.

Support & Resistance – Cheat Sheet

The following points should help the reader understand support and resistance levels in forex.

|

In this next section let’s see how support and resistance levels help in each of the five approaches to trading and also how trading with any of these five approaches can help in improving the odds when taking into consideration the aspect of support and resistance (or supply and demand) in trading the forex markets.

1. Support and Resistance during breakouts

Trading breakouts is an approach when price tends to move within a tight range over an extended period of time. The direction of the breakout, while uncertain can help determine if there are more buyers or sellers. Or in other words, if a support or resistance level is being formed.

The chart below shows how after periods of consolidation or price moving in a tight range, there was a breakout to the downside. During the process, we notice a moment where price tried to break out to the upside but failed. Traders without an understanding of support and resistance would have seen that as a long entry, but soon would have resulted in a losing trade. The trick is to look to the market structure to the left of the chart.

We notice here how past attempts to break out to the upside failed. Therefore, any attempts to the upside should be viewed with suspicion. After a while price managed to breakout to the downside. But this too should be viewed with suspicion. The trick is to trade on the retest of this breakout, which as shown in the chart depicts how the breakout level has formed resistance.

From the chart, we also notice how there was an intermediate support level formed, which is where we would be looking to book profits.

2. Trading reversals with support and resistance levels

Support and resistance also helps with trading reversals. The key to trading reversals is in identifying past support and resistance levels. In the chart below we plotted a support level based on previous price action. ( ? What is Price Action tarding? ) After a brief rally, we see a downtrend being seen on the charts. Incidentally, we see a sharp reversal from the previously identified support level. Notice how price makes a very sharp pin bar to reverse from this support level?

Without the use of support and resistance, traders would have continued on with their shorts without knowing how price would have reversed when revisiting the past support level.

3. Trading pullbacks to support and resistance levels

Trading pullbacks offers an effective way to take a safe trade entry. In the following chart, we show how in a downtrend, price made several pullbacks right to previous support levels which turned to resistance. These traders would have offered a very safe trade entry with a very strong risk/reward trading strategy.

If you look closely you will notice how the pullbacks happen into the regions of past support levels. In the above example, we see three such instances which would have offered a great way to trade with a low risk, high probability trading strategy by simply determining the trend and the support and resistance levels.

4. Psychological support and resistance levels

Another support and resistance levels is the psychological numbers. The best illustration of this could be seen in the USDJPY where it is easier to spot as well as understand.

In the USDJPY chart above, notice how price reacts to key psychological levels of 95, 100, 103 and so on?

What are psychological support/resistance levels?

Psychological support/resistance levels are nothing but round numbers. For example, 1.3 in EURUSD, 1.6 in GBPUSD or 100 in USDJPY and so on are considered to be psychological levels. These levels however are not support or resistance levels, but in fact can act as either of the two. For example in the case of USDJPY, notice how the psychological level of 100 acted as resistance earlier on, which in turn became support as price managed to break above it?

The psychological support/resistance levels also offer a way to trade and can be used as entry points or exit points for booking profits.

5. Trend line support and resistance levels

Support and resistance levels can also be determined with trend lines. In the following charts, we see a down slope trend line. While the trend lines tend to act as support (in case of an uptrend) and resistance (in case of a downtrend), they also depict the price zones as well.

In the chart below we notice that besides the trend line acting as resistance, they also depicted horizontal support/resistance levels. Look closely at the charts and you will notice how price bounced off those levels at first contact. Pay attention to the most recent price action. To the layman, it might seem as a reversal. But for traders familiar with support and resistance, will know why price bounced off from that level, which incidentally was a strong support level.

As can be seen from the above examples, support and resistance forms one of the most basic building blocks of trading. They are also referred to as supply/demand levels. By having a firm understanding of the support and resistance levels, traders would be able to improve any trading system that they currently follow. See more about TrendLine trading here

Add your review